April 2021 – Residential & Commercial Real Estate Update – Mortgage Rates Forecast ADJUSTED again!

You probably already caught up with the Bay Area Housing Market Update from the April webinar, so now, let’s move on to the housing and economic market update. You can watch the video recording here.

Now, as you see, the existing home prices in the United States had gone up 15.8% on average, but on the west coast, it had gone up the most – 20.6%, 0.1% more than the northeast region. Midwest and the south region are not too bad either, they are still double digits at 13.6% and 14.2%.

A lot of people ask – is there going to be a market crash? We had mentioned quite a few times previously in the webinar that we really don’t think there’s going to be a market crash. A main reason is that people have a lot more tappable equity in their houses right now, so even if they are struggling, they can sell their home and still be able to make money. So as you see that right now, the equity in their homes is even more than back in 2005 – 2006 right before the market crash, so I’m really not worried about the market crash at this time.

I thought it would be really interesting to share this. This is UCLA Anderson School’s Economic Forecast, and they show the California Cumulative General Fund Revenues. If you look at the fiscal year of 2019-2020, of course, when the pandemic, or the shelter-in-place hit, it definitely had gone flat, but then as soon as 2021 starts, you could see that they all had gone up actually above last year’s, this is really an indication showing that the high-tech companies in California actually are doing pretty well. So that’s why the general fund revenues still have more money than last year.

Here is another chart that they have shared with us and I thought this is very fascinating. In the 1990 Aerospace Contraction, Los Angeles rents have fallen by 14.3%, and the home prices fell by 3.5%, while employment fell by 3.5%. Now 2001 Dot-Com Bust, at the time the Bay Area rents fell by 25%, home prices fell by 2.4%, and employment fell by 7.5%. But if you exclude the leisure hospitality, retail, other services, and education, which are the sectors that have gotten affected the most in this pandemic, the employment actually fell by 10.1%. Now, if we fast forward and look at the 2020 Pandemic Recessions, Bay Area rents have fallen by 13%, home prices rose by 2.9%, but I feel like maybe this is a really big area that they’re averaging, because I’m pretty sure it’s more than 2.9%, but unemployment fell by 8.8%. Again, if we exclude those sectors that have been hit hardest during this pandemic, employment’s actually only fallen by 2.5%. So this chart shows us that really California is doing pretty well.

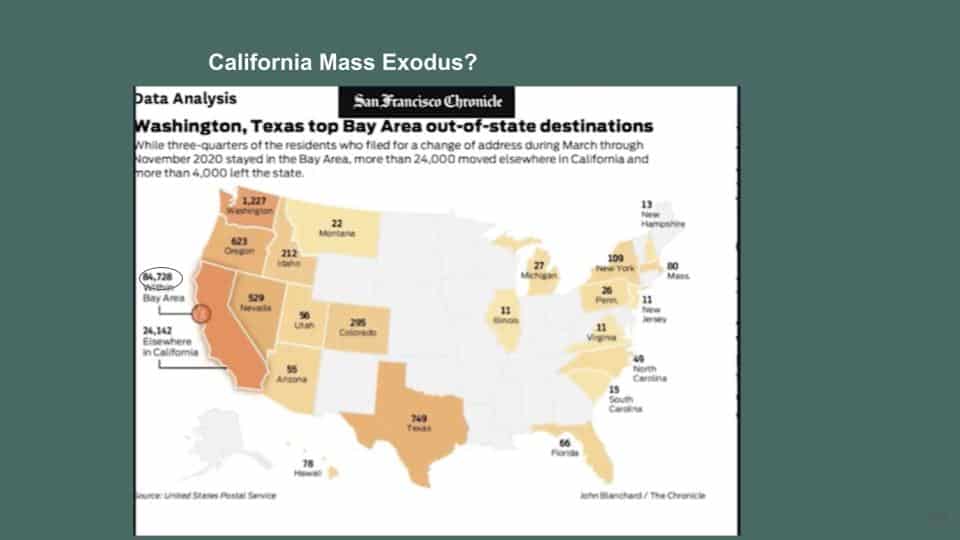

Again, around this California mass exodus topic, there is news everywhere. The San Francisco Chronicle actually did some data analysis, you will see that out of all these numbers of people moving around, 84,000 people are actually moving within the Bay Area. The way they track it is that they actually look at those residents who filed for change of address during March through November 2020, and then 24,000 are just moving elsewhere within California. Well, looking at all these other numbers, it’s just like over a thousand people in Washington, a few hundreds people in Nevada, Oregon, Texas, Colorado, and Idaho. But these are very small numbers, so it’s really not a mass exodus that people were talking about, especially considering how many millions of people we have here in California.

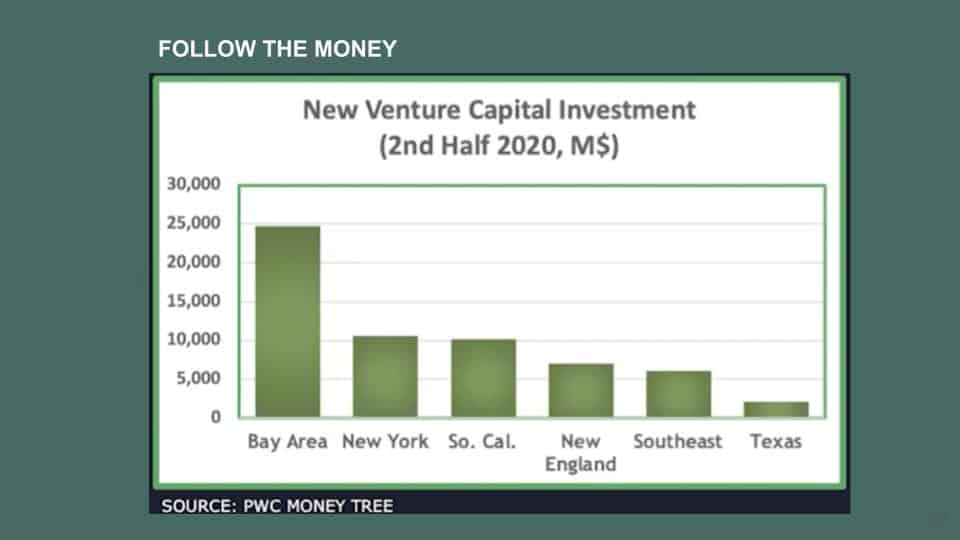

What about New Venture Capital Investments? If you look at where the money is, you’ll see that a lot of these new venture capital investments during the second half of 2020 is still in the Bay Area.

Their conclusion is that it is still about the pandemic, but there’s no mass exodus from California. The job loss remains concentrated in the human contact sectors, such as restaurants and retail sectors. The tech, logistics, and housing show strength, and California State Government revenues continue to grow.

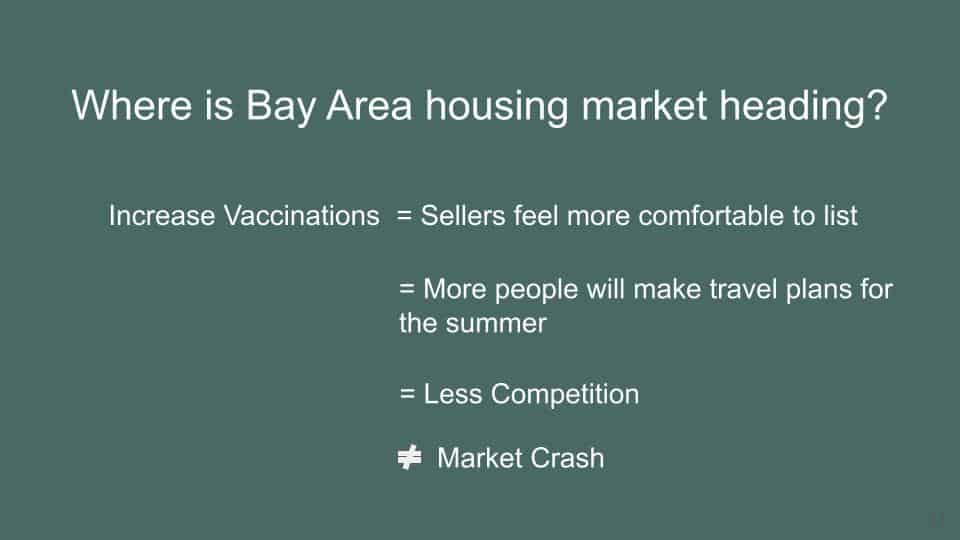

So where is the Bay Area housing market heading then? The increased vaccinations mean that more sellers are going to feel more comfortable to list their properties, but at the same time, it means that more people will make travel plans for the summer, which means that if you’re looking for homes during the summer time, maybe there will be less competition, because a lot of people have been cooped up inside the house with their kids doing virtual learning, and now when they are starting to get vaccinations, they definitely want to go out. However, during this time, it does not mean that the market is going to crash, it just means that you probably will see less competition. I honestly don’t think that the price is going to drop, but I do think that the competition may not be like right now – 20% over asking price in a lot of places. Maybe it will be more of a modest number or single digit percentage increase over the asking price. Also, maybe just less than 10 offers that you will be competing with instead of the ones that we see with 20-40 offers.

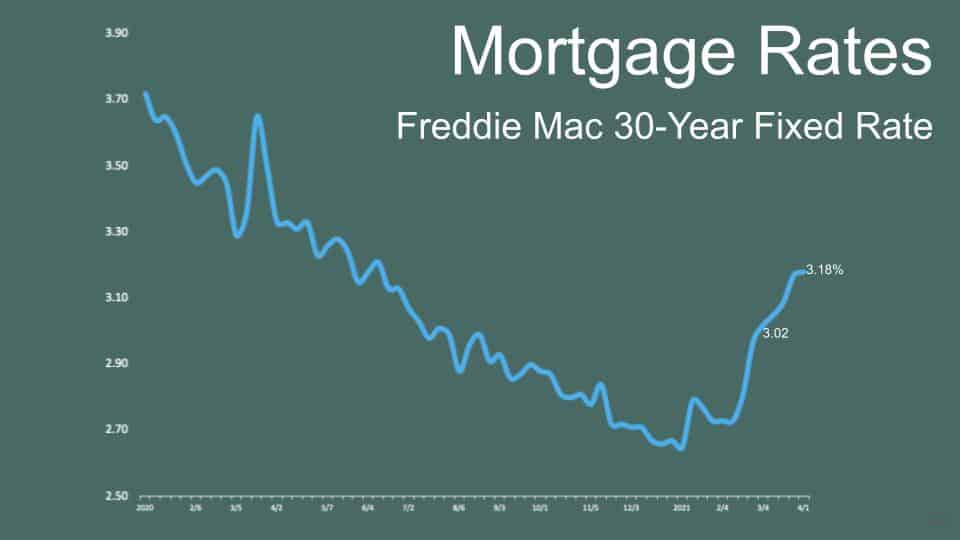

What about the residential loan updates? If you look at the Freddie Mac 30-year fixed rate, it has gone up to 3.02% last month, and then it went up to 3.18% this past week.

Then, the projections from these different agencies – Freddie Mac, Fannie Mae, Mortgage Bankers Association, National Association of Realtors. Fannie Mae and Mortgage Bankers Association actually have adjusted their projections and they went up quite a bit. If you average all four of them, they are pretty much going up about 5-12 basis points. Now, in 2Q 2021, the average of all four is about 3.05%, 3Q will be 3.1%, 4Q this year will be 3.22%, and next year, it is going to be around 3.32%. However, I just want to remind everybody that when I first started buying properties, at the time we were paying 6%, 7%, or even over 7% for mortgage rates, and 3% is half of that, so it is still very low. Even when we were having about 4% or 4.25% mortgage rate just a few years ago, we used to say that it was a historic low, so I don’t mean to scare everybody saying – oh my gosh, the interest rates are going up now, but it definitely has effect on your monthly payment, and this is also one of the reasons why people are really trying to get into the market as soon as possible, because you may not be able to get these interest rates again in the future. But who am I to say, right? We did go from 4%, where we thought it was the lowest, and then it dropped down to 3%, but I still think if you are able to hold the 3% for 30 years, and in a long term, even if you needed to rent it out, you might still be able to get a positive cash flow, so this is absolutely a very attractive mortgage rate.

Now let’s talk a little bit about commercial real estate market updates. If we look at the national rent payment tracker, we’ll see that this is actually based on the first six days of every month, and when they track it, they’re comparing 2019, 2020, and 2021. If we look at April 2019, they were able to collect 82.9% of the rent, in 2020, obviously, it dropped, but then in 2021 it went back up to 79.8%. But again, it is tracking just the first six days of the month, and then typically if they track again for the entire month, it goes back up to 90-93%.

This is from Zumper, tracking the rental amount for the San Francisco Metro Area. In Redwood City it dropped 29.3%, Santa Clara 28.7%, and Sunnyvale dropped 31.7%. These three cities had dropped the most in terms of one bedroom rental rate from a year ago. However, good news is that if you look at San Mateo, from last month it had gone up 4.5%, Pleasanton went up 3.4%, and Vallejo 4.1%. Vallejo has been doing really well even throughout this pandemic, they’ve been having very affordable prices on the housing market as well as the rental market. If you look at their year over year percentage, they are pretty much the only one that has a positive number, which is 5.5%. But if you compare one bedroom and two bedrooms, you definitely see that it seems like the two bedrooms are doing a little bit better than the one bedrooms.

Here is some interesting thinking that you can kind of rationalize why it is that 1-2 bedrooms rent decrease is a little bit more than the three or more bedrooms or the single family housing. Now, for 1-2 bedrooms, a lot of times it could be because the students are going back home during this virtual learning period, so they no longer need to rent these 1-2 bedrooms. The lower income tech workers also decide to move to a lower rent area, while the renters with no children can easily move to lower rent areas until they are required to go back to the office again. So they just temporarily moved out until they need to come back later, while the larger apartment units with three or more bedrooms typically have renters with larger households, and it’s harder to move everyone, especially if they have children. It is really important for children to be in the community, so it will be a much bigger decision factor to move away, because it’s going to be considered different schools and stuff like that, so that’s why we don’t see the three bedroom rental prices drop as much as the 1-2 bedrooms.

Marcus & Millichap has these great market reports from 4Q 2020, and they made some comments about the different commercial real estate sector markets. They said that in terms of apartments for the San Jose area, “long-term outlook bright for apartments; short-term performance murky”. “Industrial properties outperform as online shopping persist during extended lockdown”, and for retail, “extent of damage to San Jose’s retail sector still elusive; investors take cautious position”, while “dispersed office inventory may attract firms migrating away from densely populated urban centers”. As you see in this chart, the vacancy rate has gone up quite a bit to over 11.5%. This vacancy rate means that they actually moved out, and it’s not talking about whether they are working in the office space or not. I mean, counting actually having people working in the office, it would be an even higher percentage. What we notice is that way more people are looking for small office spaces, so the smaller office space is still very popular, but then as the space becomes larger, that’s when it’s really hard to find tenants as well as buyers to buy these offices.

Now, we would like to talk a little bit about what’s been going on in the residential rental regulation side. CDC just extended the national eviction ban through June 2021. It was supposed to end in March, but they just extended to June 30th, 2021.

Also, in California, this assemblyman Alex Lee had actually proposed this AB-854 regarding Ellis Act, a law that protects landlord’s right to leave the rental housing business. Also, the Ellis Act is truly allowing some of the landlords, especially those who own larger properties or the developers, who purchase these properties to completely rehab, then later on bring the tenants back. AB-854 prevents speculator evictions under the Ellis Act, and it’s the strongest tenant and rental housing protection bill in the legislature this session.

I think this is a very interesting topic, if you are interested to learn a little bit more about the residential rental regulations and what you can do to voice your opinion, you definitely need to check out our Bay Area Housing Market Townhall webinar, where we invited a very prominent attorney in San Francisco to talk about these different regulations and what you should pay attention to because that might affect your real estate investments.

Stay up to date on the latest real estate trends.

And what to check before upgrading your internet plan

HAYLEN, an Asian-owned, people-first real estate firm, selected to steward real estate process for J-Sei Home’s next chapter

You’ve got questions and we can’t wait to answer them.