Will rising rates normalize the housing market?

Quick Take:

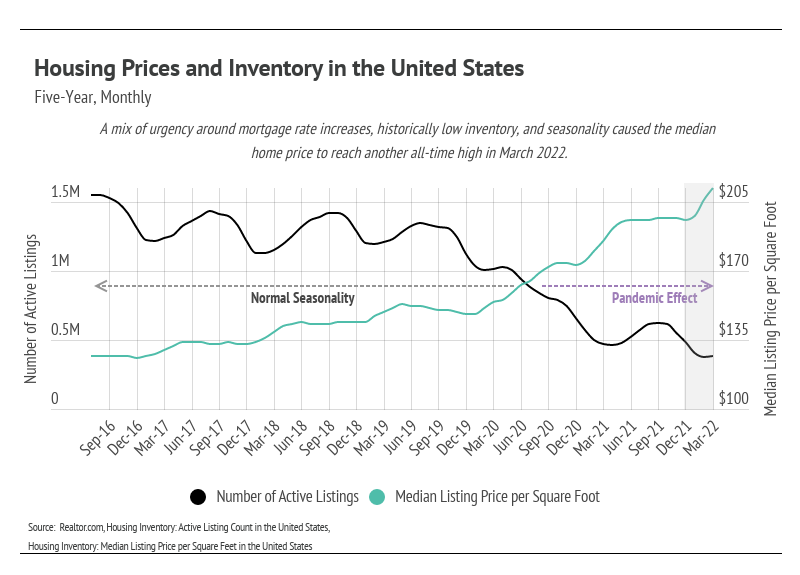

- Home prices in the United States hit a record high. Historically low inventory, coupled with an urgency around rising interest rates, incentivized homebuyers to buy sooner rather than later.

- Inflation is driving the Federal Reserve’s (the Fed’s) monetary policy. The Fed indicated at least six more 0.25% federal funds rate increases this year, so as to reach the consensus-estimated federal funds rate of 1.9% by year’s end.

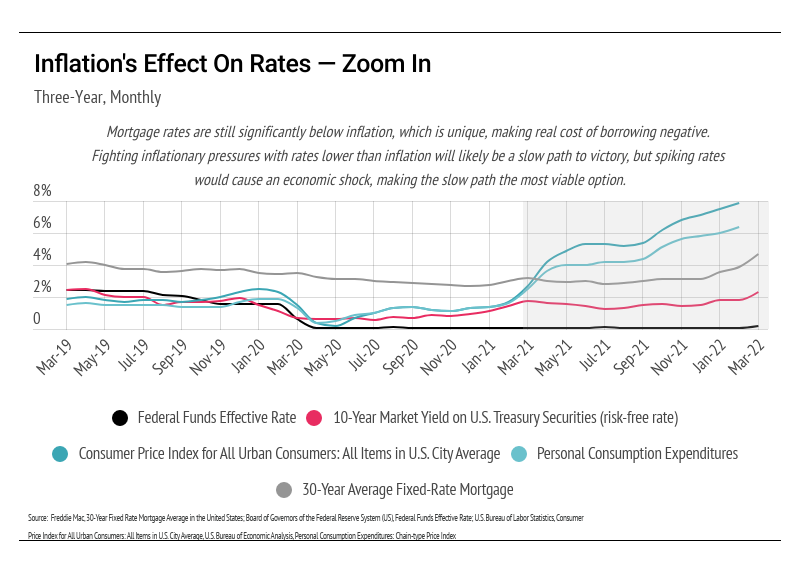

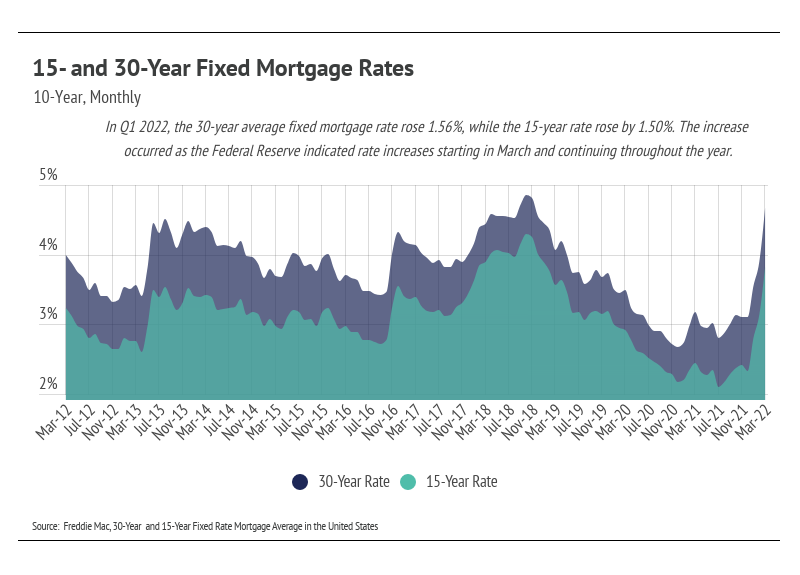

- The average 30-year fixed mortgage rate rose 1.56% in the first quarter of 2022, ending March at an average of 4.67%. The average 30-year fixed mortgage rate hasn’t risen above 5% in over a decade, but it will likely reach this milestone in the second quarter of 2022.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

Early innings for rising rates

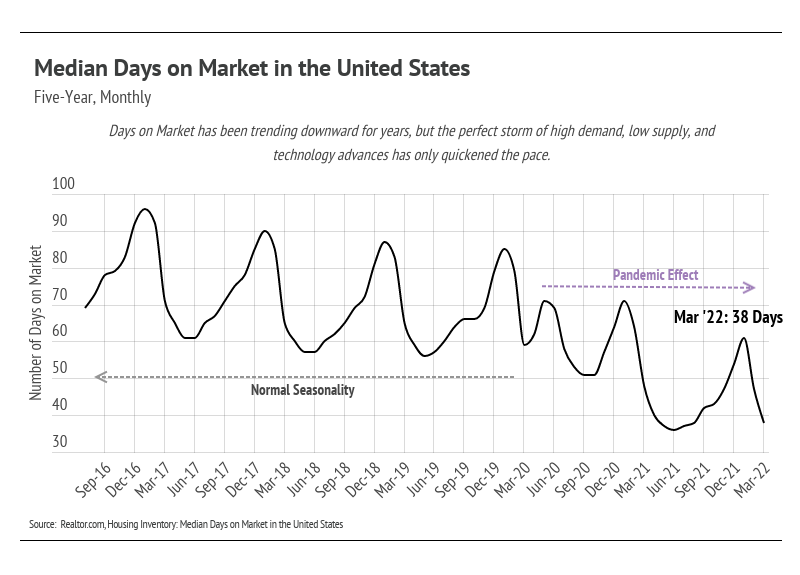

Mortgage rates rose faster than expected in the first quarter of 2022, already surpassing forecasts for the year. The 30-year average mortgage rate rose swiftly in the two weeks after the Fed’s March meeting, up 0.5% between March 17 and 31 to 4.67%. This rapid increase has spurred purchases as buyers try to lock in lower rates before they climb higher. The data reflect the urgency buyers face. Nationally, home prices have reached yet another milestone: hitting above $200 per square foot, the highest level in history. But is the urgency justified? The answer is 100% yes, assuming you find the right home for you. Let’s dig into the numbers a little.

The average 30-year mortgage rate was 3.11% in December 2021, rising to 4.67% by the end of Q1 2022. If you bought a home in December and financed it with a $500,000 mortgage loan at 3.11%, your monthly spend on principal and interest would be $2,138 — versus $2,584 if you got the same loan in March 2022 at 4.67%. Over the life of the loan, you’ll spend $160,560 more at 4.67%. In short, every percentage point matters significantly. As an aside, refinancing has decreased 60% below last year’s levels, according to the Mortgage Brokers Association. Economists and real estate experts seem torn between rates peaking just below or just above 5%. Because the Fed indicated the path of rate hikes for the rest of the year, mortgage rates increased in anticipation and are likely to be affected less when the Fed moves the federal funds rate in the future, if it sticks to its schedule. At this point, we can almost guarantee that rates will not decline substantially this year.

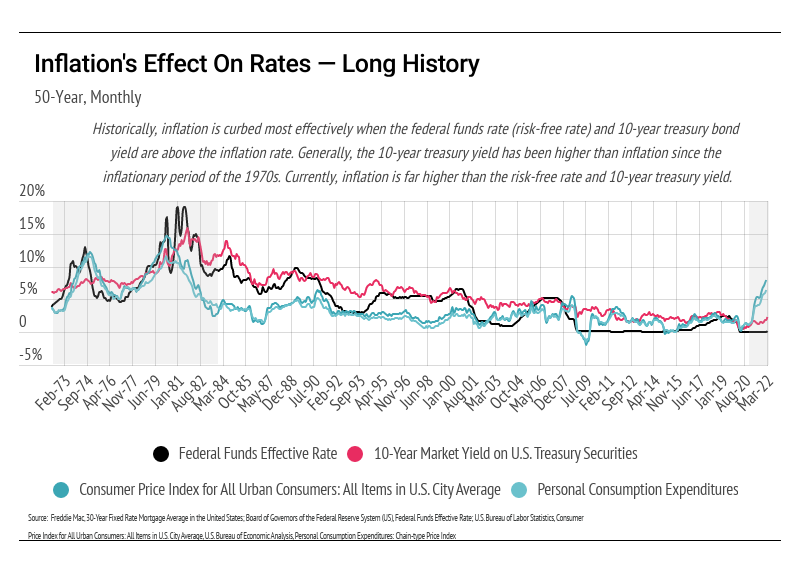

As we look at historical trends in inflation, we are curious about how effective the Fed’s rate hikes will be. Rates rose significantly in the 1970s, partially due to the inflation rate at the time. Mortgage rates peaked at over 18%, which is unimaginable today. As we look at the long-term data, we see that inflation tends to decline when the federal funds rate is above the inflation level. Currently, the federal funds rate is far below inflation, and the Fed doesn’t plan to lift it near the inflation level because of the economic shock that would ensue. The current cost to borrow is actually negative, which may incentivize more people to borrow and spend more in the short term, driving inflation higher. At current mortgage and inflation levels, the borrower, not the lender, gains around 3% from borrowing.

In addition to rising rates, supply still drives home prices. In March, the housing supply ticked up ever so slightly from the all-time low in February. We are entering the spring buying season, however, with the lowest inventory on record. From March 2020 to March 2022, the housing supply declined 62%. Over the past three months, which had the lowest inventory on record, home prices increased nearly 10%. Rising rates, in the short term, boost demand because potential homebuyers want to get ahead of the increase, but in the long term, they reduce demand. Because the market is so undersupplied, less demand is actually a good thing. Home prices simply cannot maintain the rapid increases. Although a housing bubble isn’t likely yet, a sustainable growth rate is better and safer for the long term.

Big Story Data

Our team is committed to continuing to serve all your real estate needs while incorporating safety protocol to protect all of our loved ones.

In addition, as your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we put together this monthly analysis breaking down specifics about the market.

As we all navigate this together, please don’t hesitate to

reach out to us with any questions or concerns. We’re here to support you.