February 2022 Newsletter – Greater Bay Area Local Lowdown

Quick Take:

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

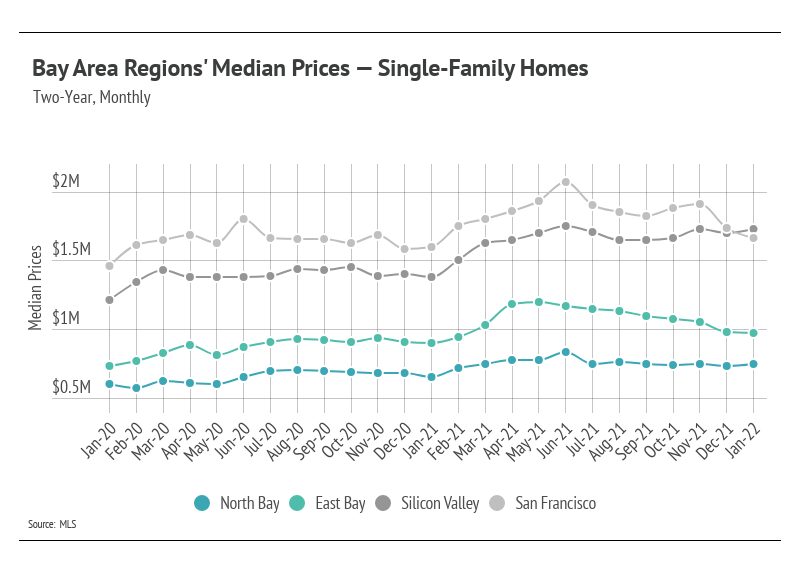

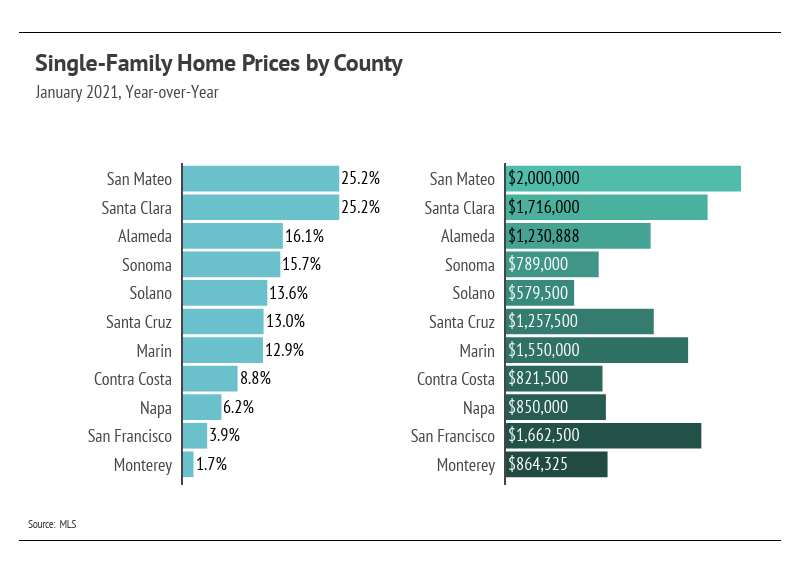

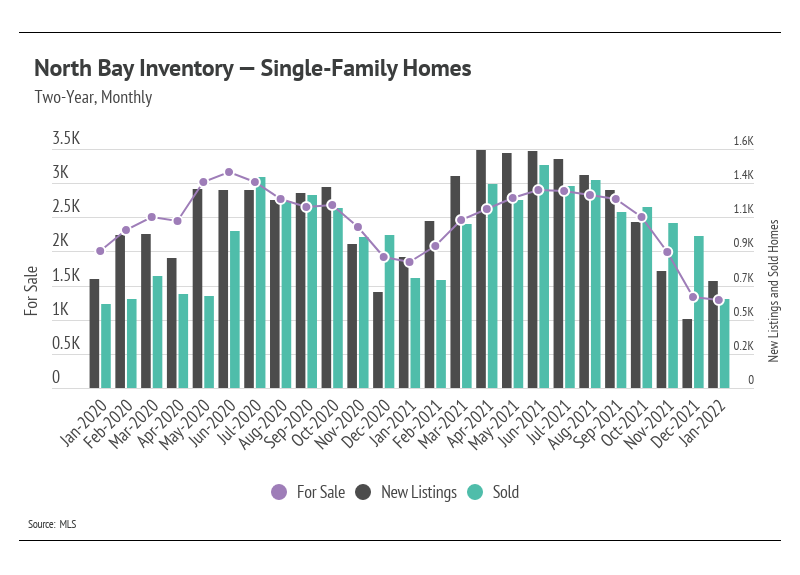

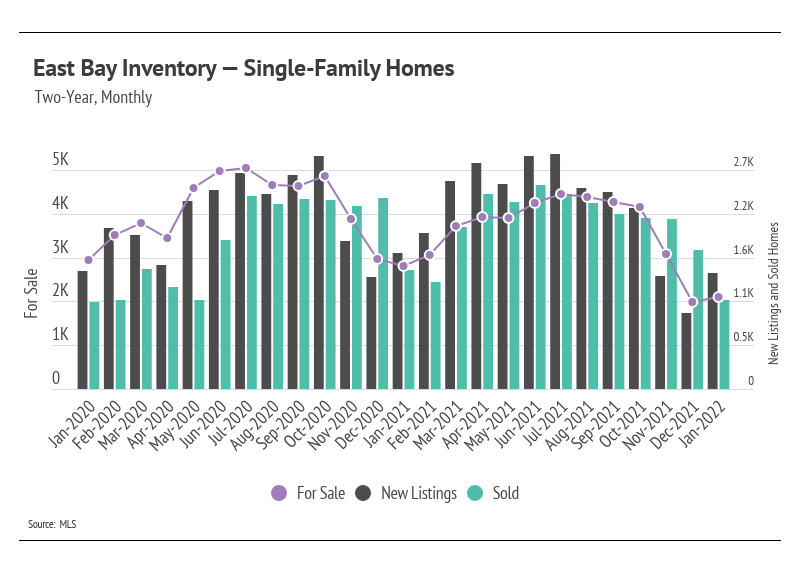

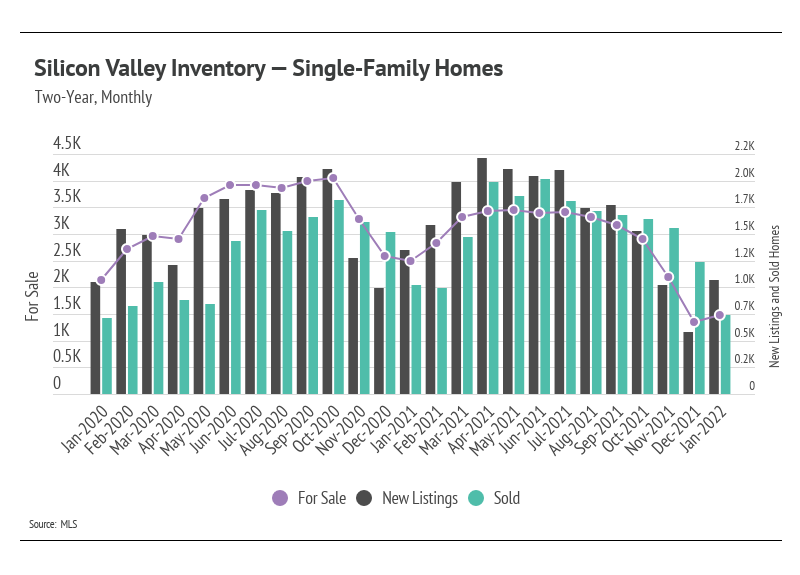

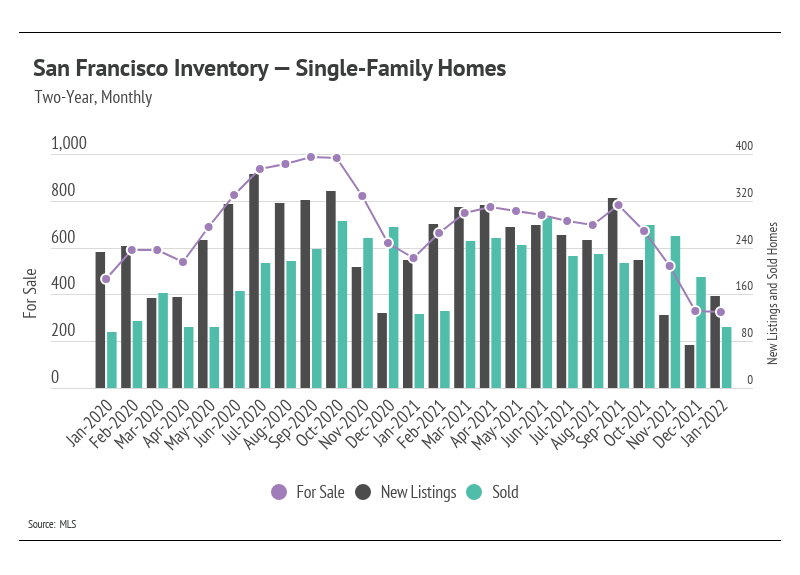

The single-family home market in the Bay Area began the year below all-time highs as the market cooled from the huge price gains at the beginning of 2021. After prices appreciated significantly in the first half of 2021, it made sense that price appreciation slowed or reversed in the second half of the year, a trend that has continued into 2022. The housing market in the Greater Bay Area, however, has a major advantage in that a high number of affluent people simply want to live there, which has reduced inventory to record lows.

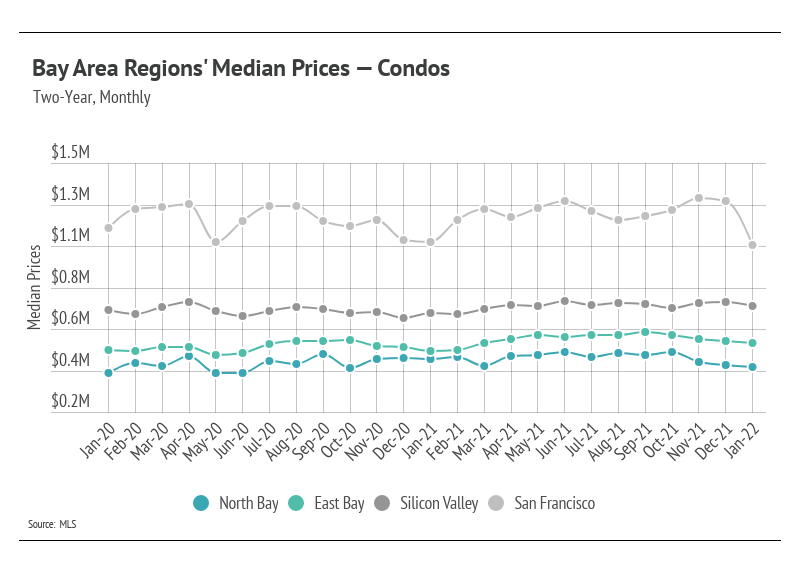

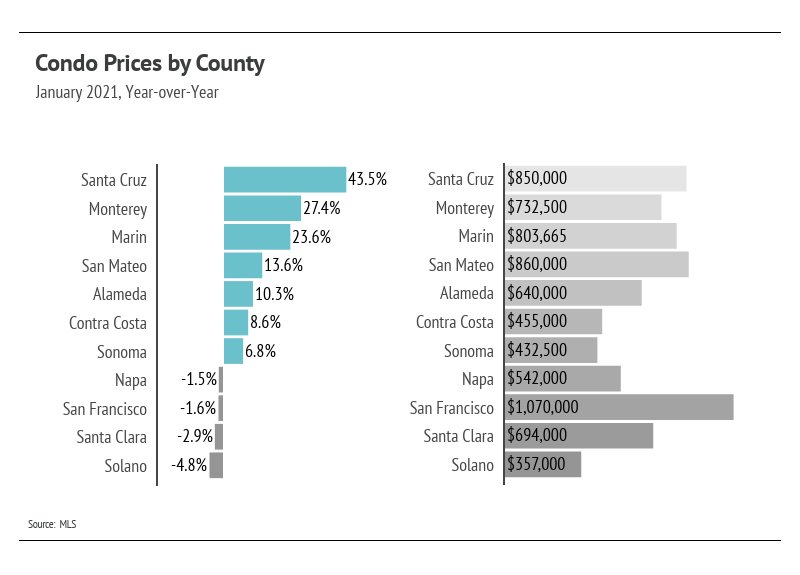

Condo prices have held relatively stable over the last several months with the exception of San Francisco condos, which declined sharply from the November peak. After digging into the San Francisco January data, we found that a higher-than-usual number of smaller condos were sold, and that condo prices weren’t actually falling. The pandemic hit demand for condos harder than single-family homes in the Bay. However, sales indicate that demand is back, although we expect price appreciation to slow as we move through the winter months, a seasonal norm.

Mortgage rate hikes really only move demand in one direction: lower. We are now entering a period during which factors that affect prices are more mixed, unlike the past two years when all the factors caused prices to increase. Rising interest rates, which will hopefully curb the still-rising inflation, will make homes less affordable and dampen demand. But inventory is so low that even with less demand, the market will likely be undersupplied. It might seem counterintuitive that home prices can still appreciate after increasing so much over the past two years, but with inventory at record lows, home prices in 2022 will still increase — though at a slower rate than in 2021.

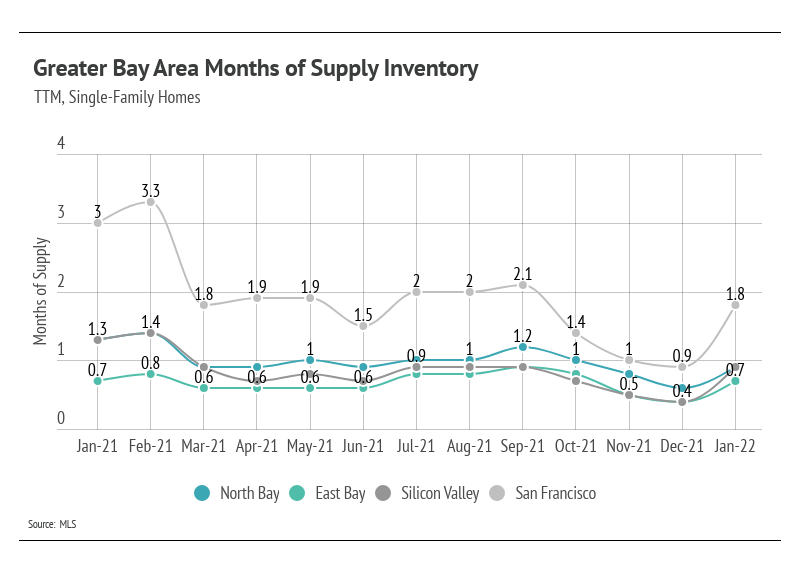

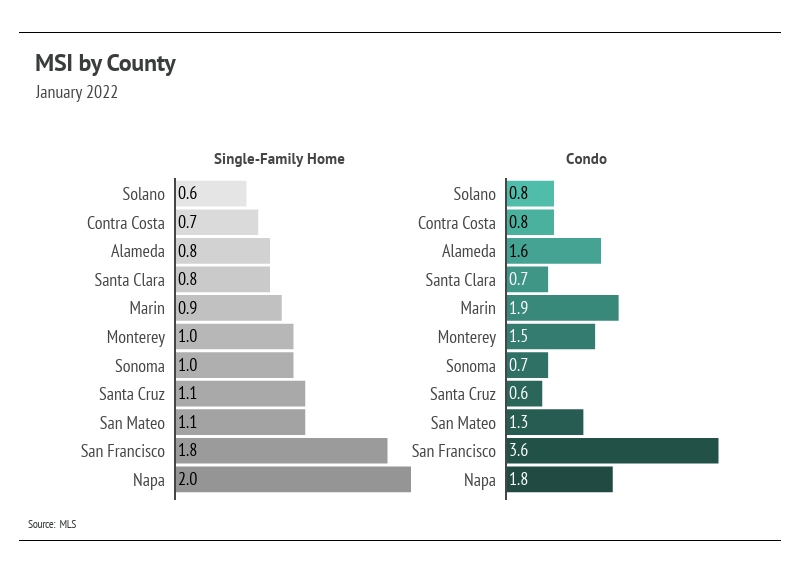

We entered 2022 with historically low inventory. The sustained high demand and lack of new listings over the past year brought supply to record lows across markets. We are seeing that far more people want to live in the Bay Area than want to leave. Sales have been incredibly high, especially when accounting for available supply, again highlighting demand in the area. Sellers can expect multiple offers, and buyers should come with competitive offers. The high demand we’ve seen over the past year might wane as interest rates increase; however, the supply is so low that the market can handle a drop in demand without negatively affecting prices.

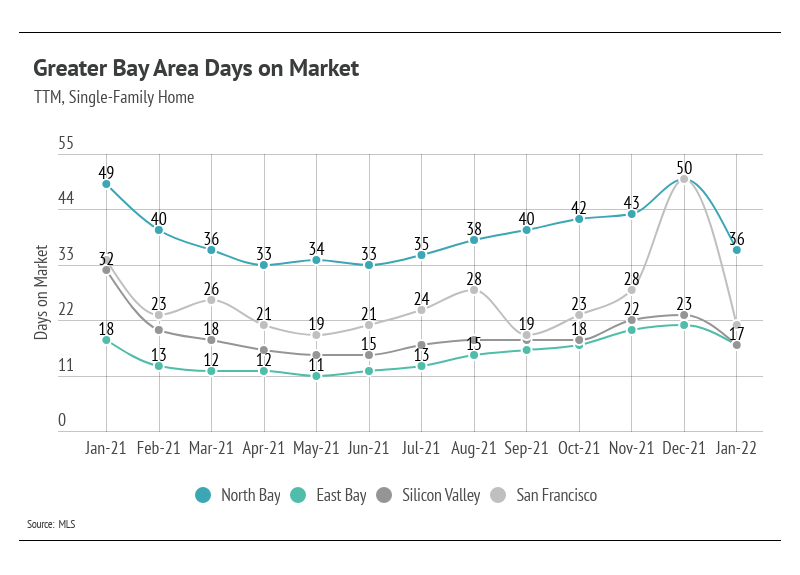

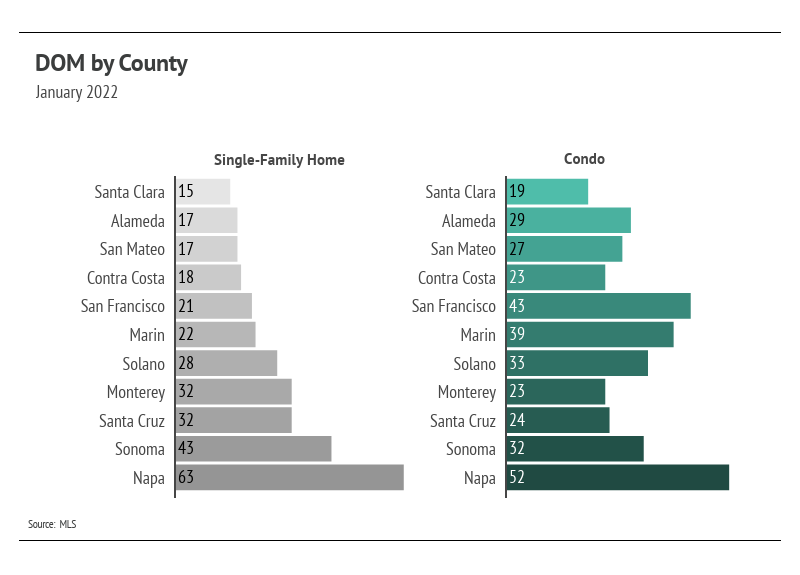

Homes are still selling extremely quickly. The Days on Market reflects the high demand for homes in the Greater Bay Area. Buyers must put in competitive offers above the list price of the home.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). In January, MSI remained exceptionally low in the Bay Area, indicating a strong sellers’ market. Notably, the January increase in MSI is less instructive than usual — sales slowed because inventory is so low, not because of lack of demand.

Our team is committed to continuing to serve all your real estate needs while incorporating safety protocol to protect all of our loved ones.

In addition, as your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we put together this monthly analysis breaking down specifics about the market.

As we all navigate this together, please don’t hesitate to reach out to us with any questions or concerns. We’re here to support you.

Stay up to date on the latest real estate trends.

HAYLEN, an Asian-owned, people-first real estate firm, selected to steward real estate process for J-Sei Home’s next chapter

You’ve got questions and we can’t wait to answer them.