Get Ready For the Summer! – Biden Tax Plan Effect, Housing Inventory & Mortgage Trends & Much More!

Welcome to our May Bay Area Housing Market Townhall! Here is an outline of all the topics that we will be discussing today:

The May Bay Area Market Update video recording can be found here.

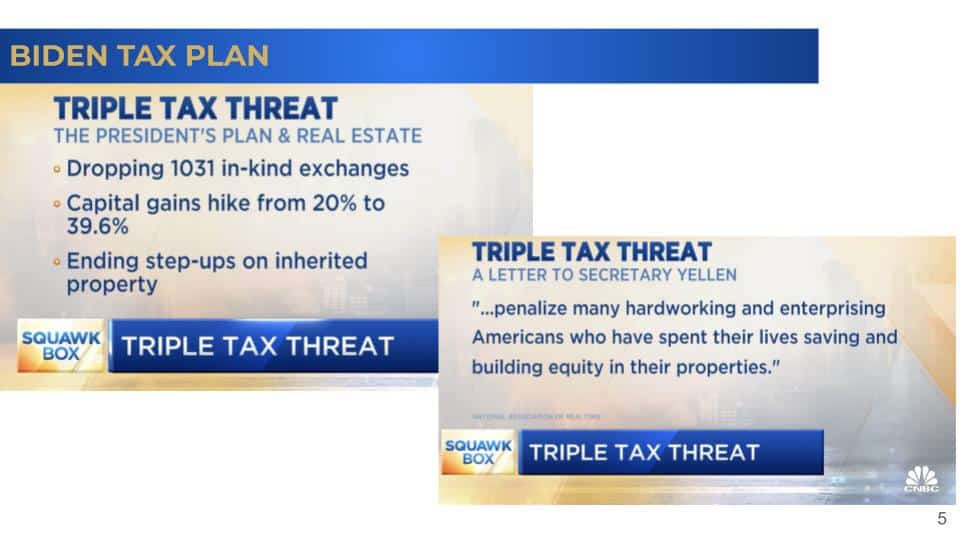

Biden Tax Plan Effect in Real Estate

So, I know a lot of you when you heard about the Bien Tax Plan, especially if you are Real Estate Investors, you probably get a little bit worried and nervous, because he is proposing dropping 1031 exchanges, and then hiking capital gain tax from 20% to 39.6%, especially for those who have more than 1 million dollar income. Also, he had mentioned ending step-ups on inherited property.

As you can imagine, a lot of people are really against these tax plans, and one of the common complaints is that it seems like these tax plans are “penalizing a lot of hardworking and enterprising Americans who have spent their lives saving and building equity in their properties”. And personally, I can definitely feel that as well.

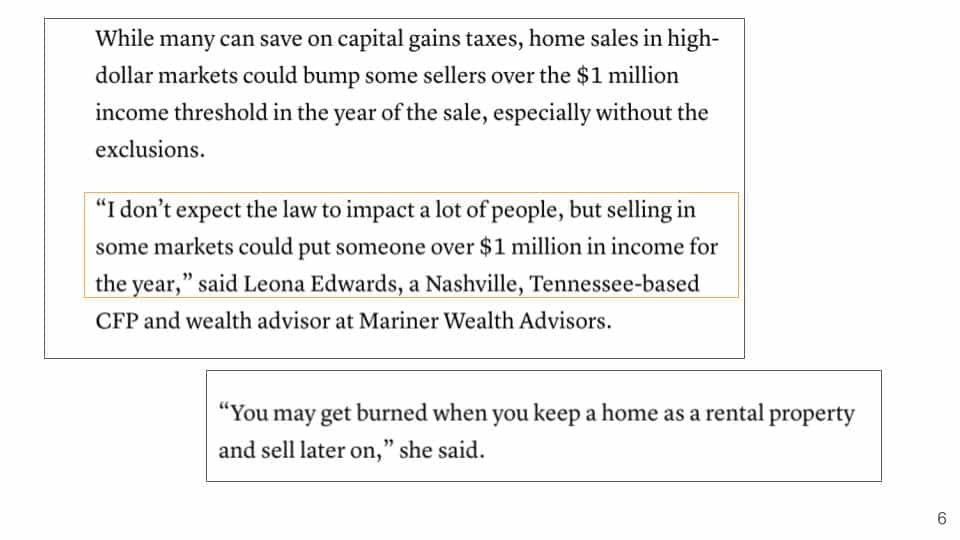

Because we have so many talks about these tax hikes, and people are really worried that the housing market might crash. This is from Leona Edwards, who is a Tennessee-based CFP and wealth advisor at Mariner Wealth Advisors. She said that “I don’t expect the law to impact a lot of people, but selling in some markets could put someone over $1 million in income for the year”.

What it means is that especially for areas like ours here, if somebody had bought a property, let’s say 30 years ago, and now their property had increased value, and it had over $1 million capital gain in value. So when this person sells it that year, he or she is going to earn over $1 million, and that’s when it’s going to put them over that threshold, and they are going to get taxed quite a bit.

That scares a lot of people, and also, especially those who used to live in their property, and then they decide to move away to another property, and they want to keep this one as a rental property. If you have been doing that, you are keeping it as a rental property, and you miss that capital gain exemption as a property owner, which means that by the time you sell this property, you look back five years, If within these five years, there are two years that you’re living in this property, you can still enjoy that $250,000 capital gain tax exemption as a single homeowner or a married couple will be up to 4500,000 capital gain exemptions. So technically, you can rent it out for up to three years, and you can still get that exemption. But now, if you have gone over that, you’ve decided to sell in six years, then you might be subject to this capital gain tax, so you have to be careful and think about if you want to keep this longer-term or not.

Housing Inventory and Demand

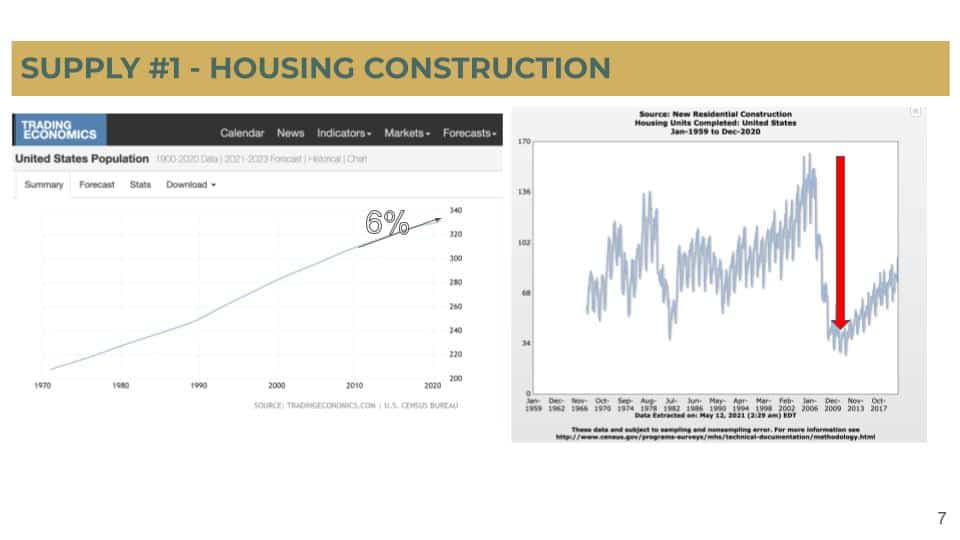

Now, what about the housing Supply? Of course, we talked a lot about home construction. In terms of home construction, we have to understand that we need to look at the population. So the US population, as you can see, has been going up all these years, right? But then if you look at the construction and around 2006 to 2009, look at that sharp drop, it’s crazy – I mean, how is it possible? We have more people in this country but we are not building more homes. It doesn’t make sense at all. Especially, if you look at the last decade, 2010 to 2020, it had gone up 6% in the population.

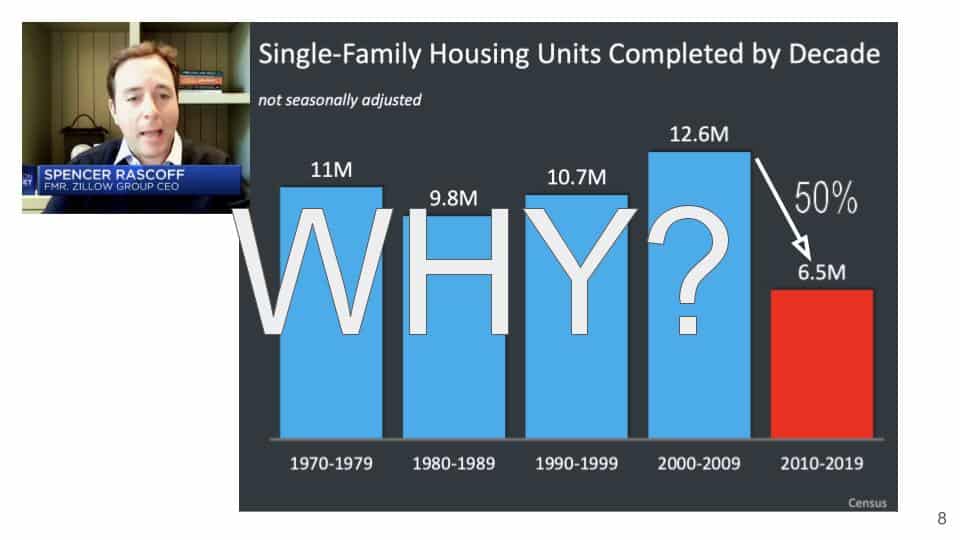

So if you really look by decades, this is actually by Spencer Rascoff, the former Zillow Group CEO, he looked at the number of construction for single-family homes. In the last decade,we had constructed half of what we used to construct in the previous decade. And you know, it’s really mind-boggling, especially when we are talking about – oh, is there a bubble? If we don’t have enough supply, we don’t have enough housing, there’s a shortage, then obviously, people are going to pay more for it, right?

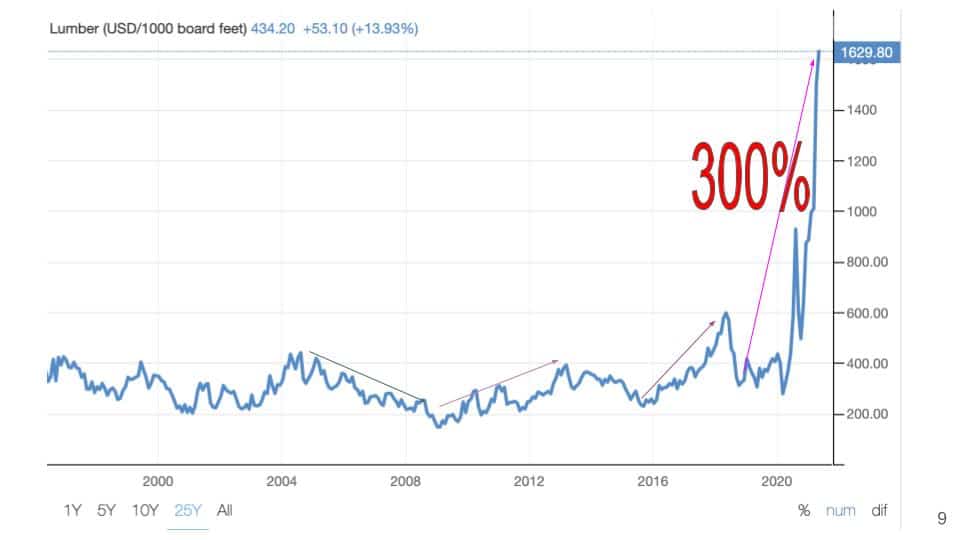

So why is it that we are not building more? One of the things that you can look at is the lumber cost. The cost of lumber was going down from 2004 to 2008, That’s why you saw that there was a hike earlier with the new construction during that time. But since then, you see that it has gone up and that error is getting steeper and steeper. And look at that, honestly, just in the last year, it has gone up 300%. This has caused a lot of pressure on developers, as a matter of fact, the cost for them to develop has gone up so much that some of them might as well just abandon their projects and not to build any more.

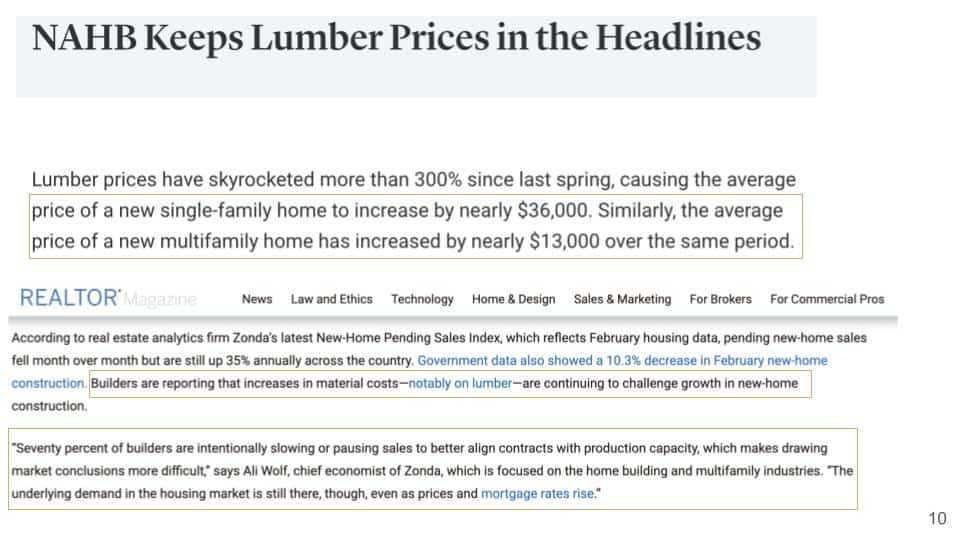

That’s why the National Association of Home Builders is constantly talking about this, and they have said that “lumber prices skyrocketed more than 300% since last spring, causing the average price of a new single-family home to increase by nearly $36,000. Similarly, the average price of a new multifamily home has increased by nearly $13,000 over the same period”. The Realtor Magazine also has said that “Builders are reporting that increases in material costs – nobly on lumber – are continuing to challenge growth in new-home construction”. This is one of the reasons why we are seeing home prices have been going up throughout the country.

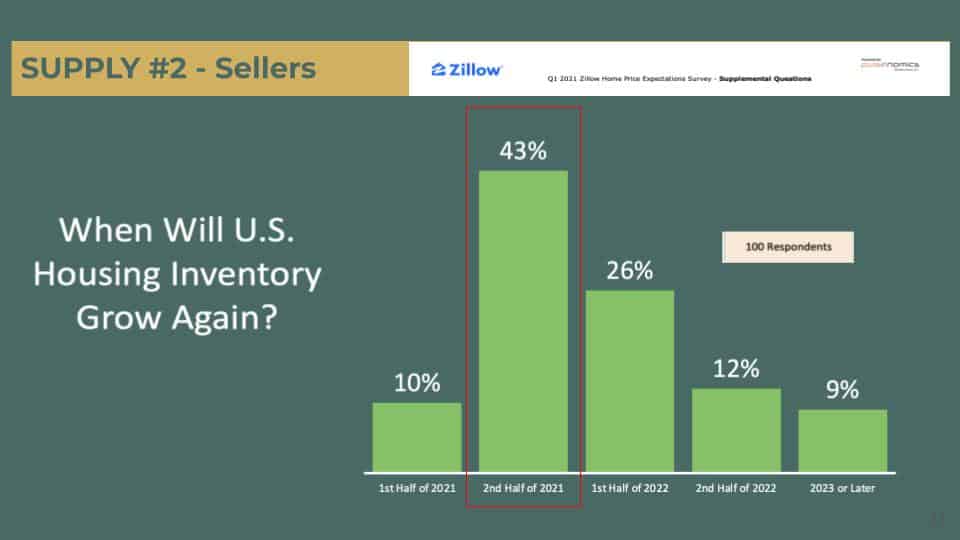

Now, there’s another aspect of supply – are existing homeowners going to sell their home? Zillow did this survey with about 100 respondents. The question is “when will US housing inventory grow again? From those 100 responses, most of them believe that the 2nd half of 2021 is when the inventory will go up. This is just what the people think, but as a matter of fact, we have been saying to our clients as well that we are expecting the inventory to go up a bit during the 2nd half of the 2021.

Why is that? Vaccinations, right? People are getting vaccinated. Sellers were worried about the COVID situation at the time, even though we have a lot of protocol – we don’t allow open houses, we make sure that we have all these posts at the door saying that you have to wear your mask, you have to wear your shoe covers, and we also provide hand sanitizer and wipes. But really, a lot of sellers are still really worried about letting people come into their houses. So now that more and more people are being vaccinated, we believe that more homeowners will be more comfortable letting people come in and show the property.

This is exactly what Ali Wolf, the chief economist for Zonda had said, “others will want to wait until the vaccines are widely distributed. This suggests more inventory will be for sale in late 2021 and into the spring selling season in 2022”.

Supply seems to be going up slightly. What about demand? This is specifically talking about the summer for this year. Same thing, because of the vaccinations, I’m sure a lot of you are planning on traveling, especially if you have kids, they are going to be out soon. You know, finally, you’ve been cooped up inside the house for a year and a half. My kids just started going back to school as well, and my husband and I are almost there – next week we’ll be getting our second shot. Right away, we’ve been talking about where we should go during the summer. This is not just us, a lot of others as well. So we definitely see the numbers hike up in terms of the number of travelers throughout the country domestically and also internationally. Because of that reason, last year we had this really high demand, because there was nothing else to do but stay home – looking at the screen, looking at the inventory, and when you look at beautiful homes, of course, you really want to move, right? But this year, we think that during the summer, we probably will have less buyers. So if you are a buyer, and you are really getting frustrated with the market, I would say that – you know what, I think the market is going to get a little bit better during summertime, if you’re not traveling, maybe this will be a really good time for you to try to find a home. Because we might see more inventory, and also we might have less competition.

Also, did you guys know that because of this pandemic, households have $1.5 trillion in excess savings, and it may rise to $2.4 trillion by mid-year? And it is expected that 20% potentially spent in the first reopening year, which is 2021. So a lot of people are really spending their money, maybe on home remodeling – how many people have been doing remodeling projects during this year, right? Some people have really saved up quite a bit of money and potentially start buying homes. Even if it’s not buying a home, they’re really trying to spend the money now, or feel that they can’t spend the money.

Job Data

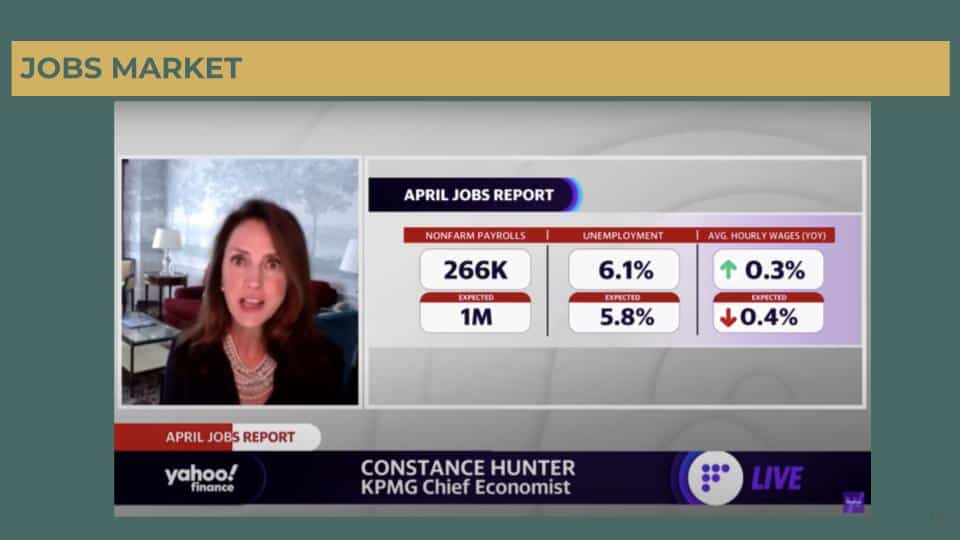

This slide goes to the job market. If you have heard, just this past April, the expected job increase was about 1 million jobs. But it came out on the job market reports that they only added 266K jobs, way below their expectation. They were expecting 5.8% unemployment, but the data was 6.1%. And as for the average hourly wages, they had expected it to come down 0.4%, but actually, it went up 0.3%. I was listening to Constance Hunter, she’s the KPMG Chief Economist. She was commenting regarding this big discrepancy in terms of expectations and the actual job reports.

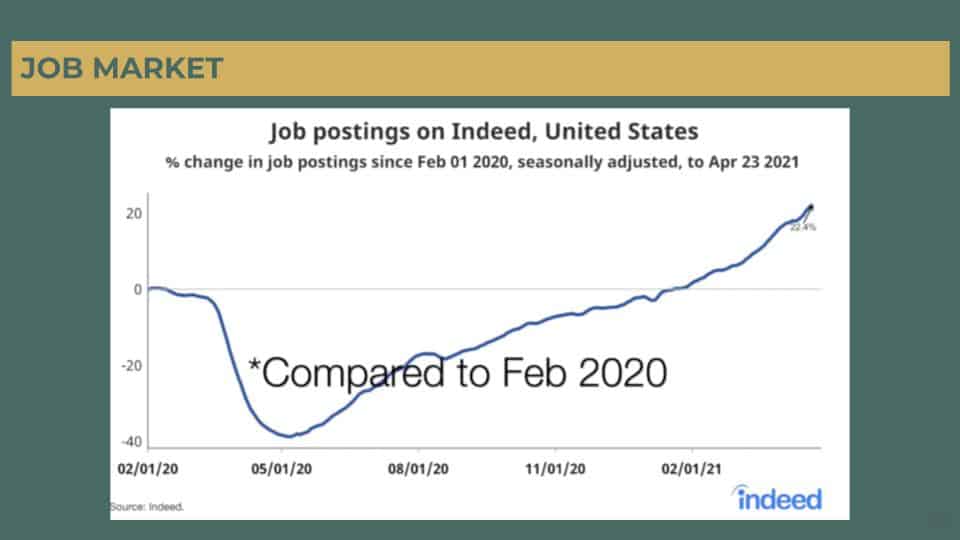

If you look at the job postings on Indeed, the number actually went up quite significantly. Then the thing is, if it has gone up so much, how come we didn’t have a big increase in terms of jobs? It was only 266,000.

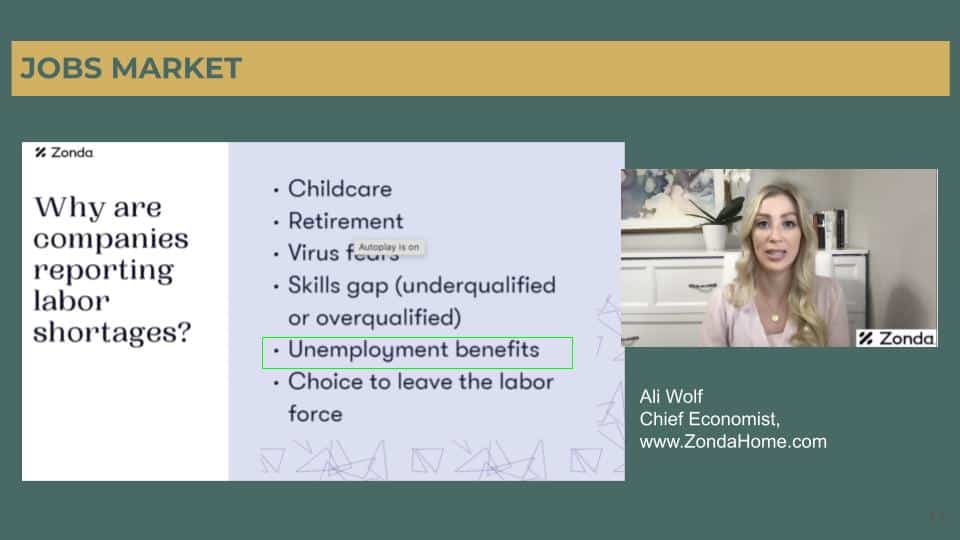

There were quite a few different explanations. It could be because, you know, some of the kids are still home. For example, my children are still not really going to school full-time, not 5 days a week, just part-time. So we still have to be home. Maybe because of retirement, or maybe they’re still afraid of the virus, or there might be a skill gap. One of the very interesting factors is the unemployment benefits, which is actually discouraging people to go back to work, because if they go back to work, they actually may not be getting as much as the unemployment benefit. So that also could be one of the reasons that even though there are a lot of companies posting jobs, they just cannot hire people. If you want to read more about it, Ali Wolf has quite a few reports about this and talked a lot about why it is that we have such a great job market, but at the same time, not a lot of people are being hired.

As you can see, the Wall Street Journal also said that the companies are ready to hire, but they just cannot find workers. This is really an indication that the job market is doing well, but it’s just that the people are not ready to go back to work yet.

Commercial Real Estate Market

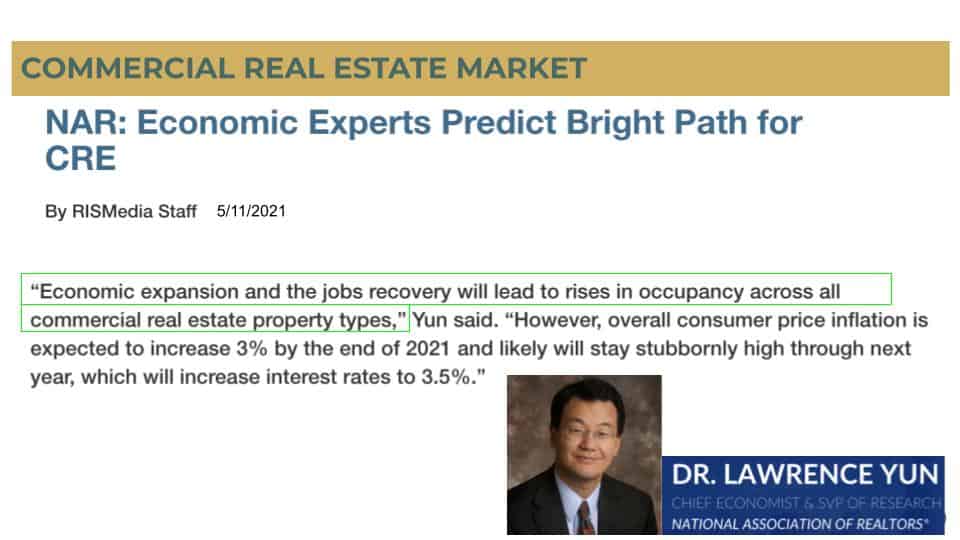

When the job market is doing well, that actually will affect the commercial real estate market as well. From National Association of Realtors, “Economic Experts Predict a Bright Path for CRE”. Lawrence Yun, the Chief Economist for National Association of Realtors, said that “economic expansion and the jobs recovery will lead to rises in occupancy across all commercial real estate property types”.

Just from my personal experience, I see that as well. We had office building listings for a while, but nobody was asking about it. And then all of a sudden, in April, boom, all these people came out and started inquiring about the office buildings. They’ve been there, but before, people didn’t have that confidence, and now a lot more companies are out looking to lease a space and also looking to purchase. So definitely, on the commercial real estate side, we definitely have seen a lot more activities, you could tell that people are a lot more positive about the economy.

Mortgage Trends

What about the loan situation and the mortgage rates? On May 6th, Money.com reported that “Current Mortgage Rates Stick Below 3% For a Third Week”. They see a trend where the 30-year mortgage actually has come down. It had a little spike, but then it came down to 2.96%, which actually looked pretty good.

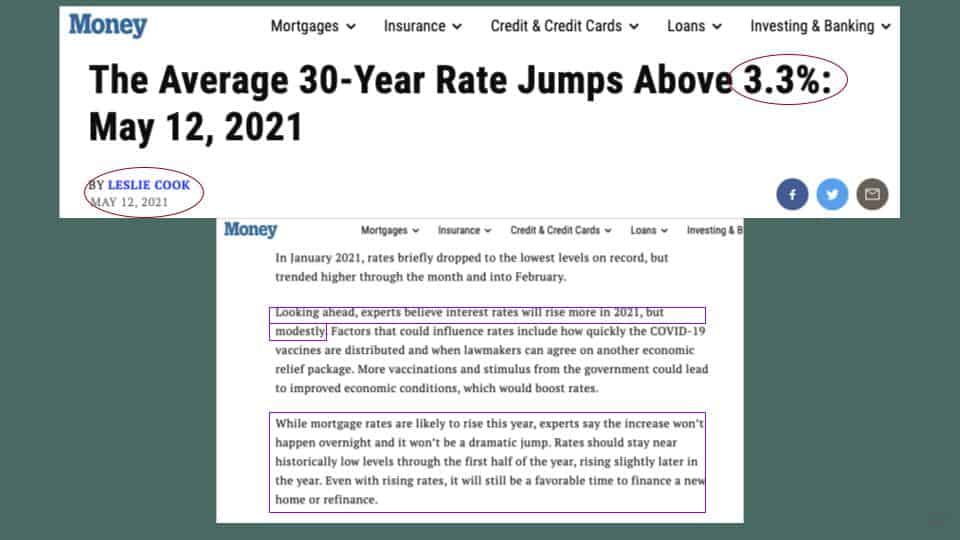

However, on May 12th, they reported that “The Average 30-Year Rate Jumps Above 3.3%”. Six days later, it was no longer under 3% but 3.3%. You know, things can change quite fast. They also said that “looking ahead, experts believe interest rates will rise more in 2021, but modestly”. “While mortgage rates are likely to rise this year, experts say the increase won’t happen overnight and it won’t be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with the rising rates, it will still be a favorable time to finance a new home or refinance”.

We all know that the housing market has been fueled by these low-interest rates and that’s why we have so many people out and the demand is high. Even though the rate has gone up to 3.3%, honestly in 2019, it was at 4%, 3.3% is still a really good rate.

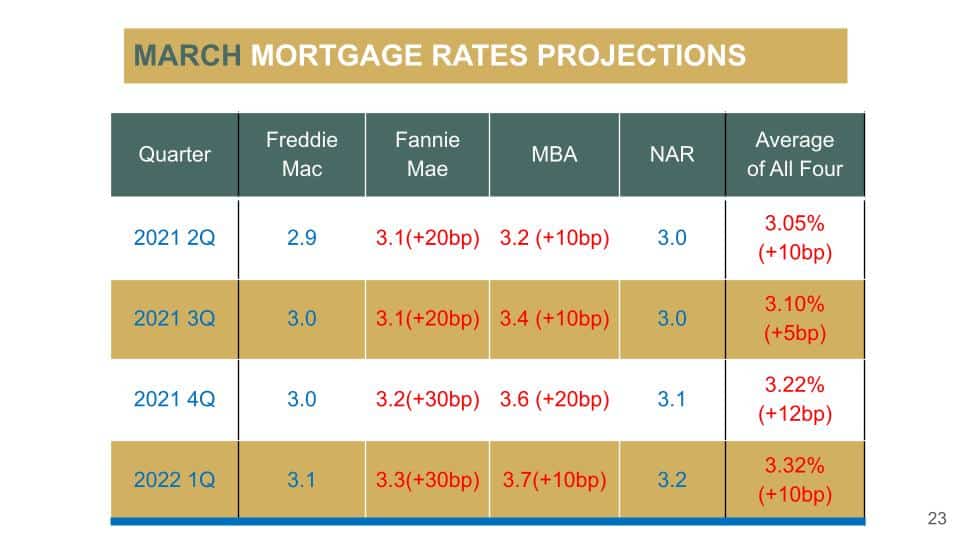

We’ve been sharing this chart with you. This is from last month, and I kept it here. This is the mortgage rates projection from March. As you see, Fannie Mae and Mortgage Bankers Association had increased their projections. 2021 2Q, as we just saw, it was just 2.96%, and the average of projections from all four agencies was at 3.05%, which was pretty close to that 2.96% 30-year fixed.

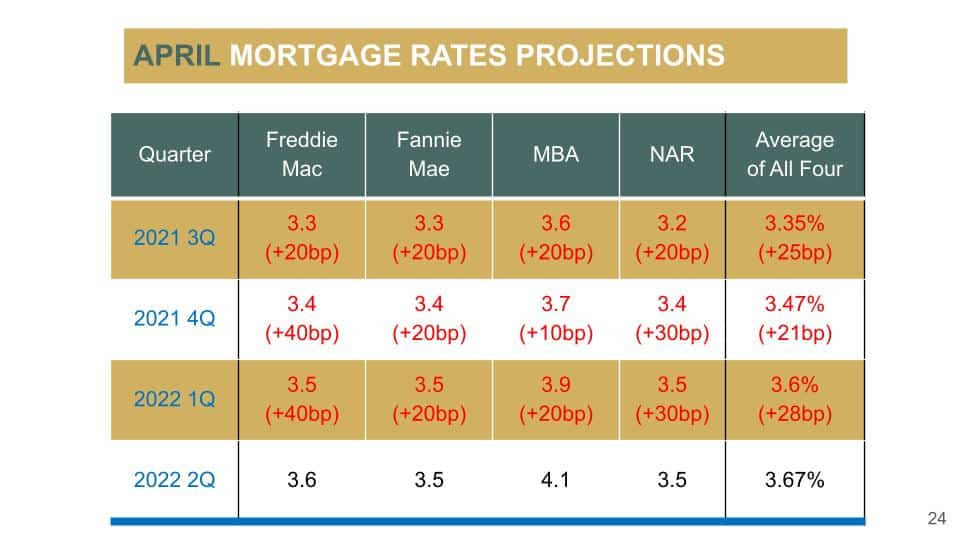

But let’s take a look now, more adjustments are being made. Every single agency is changing their mortgage rate projections, and they all increased their projections by about 20 basis points across the board, and we have new projections for 2022 2Q. I know it sounds a little bit scary that the rates keep increasing, but honestly, they’re not really increasing that much.We are still talking about in the threes, and in 2022 2Q, the average is still about 3.67%, which is still lower than what we had in 2019. So yes, it is going up, but historically speaking, they are still pretty low mortgage rates.

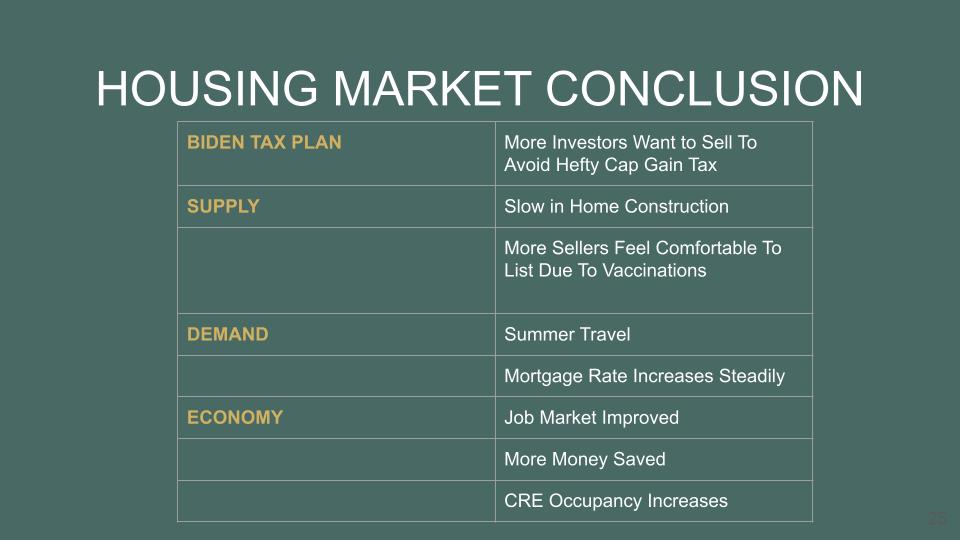

Conclusion

Let’s conclude what we just talked about. Regarding the Biden Tax Plan effects, we probably will expect more investors to sell because they want to avoid those hefty capital gain tax. Also, they are afraid that they might not do the 1031 exchanges anymore, although a lot of people don’t think that’s going to pass.

In terms of housing market supply, again, slow in home construction, so it is still going to have some limit in the home supply inventory. But at the same time, for the existing home, more sellers are going to feel comfortable to list because of the vaccinations. However, I do think that it’s not going to be as significant as home construction, where they will build so many at a time. Even though we have more sellers coming out to sell, it doesn’t mean that we can catch up with the demand.

Now, demand in the summer is probably going to come down a little bit, and the mortgage rate is going to increase steadily. As a result, we probably will see slightly less demand during the summer. Again, a reminder for buyers who have been looking for properties – please don’t give up yet, you still have the summer, take this opportunity, I think you might have the chance here.

We’re doing well in terms of economy. The job market has improved, more money is saved, and also commercial real estate is showing a really bright future. We see occupancy increases, which is a good sign.

Bay Area Housing Market Stats

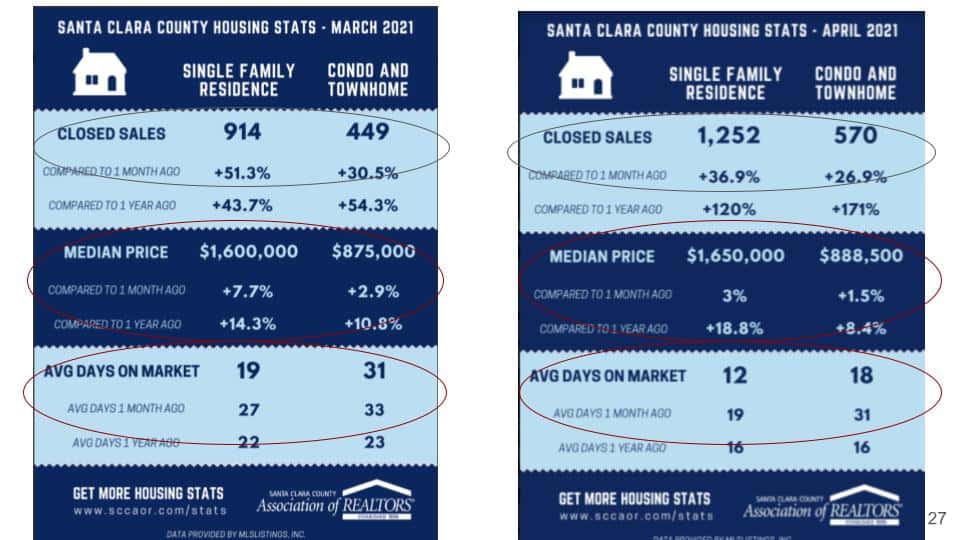

Lastly, let’s go over a little bit of the local markets and what’s going on in the Bay Area. Santa Clara County Housing stats here, I just want to show you that we have again increased about 30% on closed sales compared to last month. Every month, we see a significant increase from the prior month. The median price for SFR went up to $1.65 million in Santa Clara County, which is an increase of 3% from last month, and an increase of 18.8% compared to a year ago. They are also only staying on the market for 12 days, which is very low. On the other hand, for condo and townhome, the number of closed sales have gone up as well – about 27% since last month and 171% since last year to 570 sales. The median price went up by 1.5% to $888,500, and they are also only staying on the market for 18 days now. This is really tremendous because we’ve been really worried about the condo market for a while since last year. Now, we definitely see that the condo and townhome market is moving pretty well.

How about San Mateo County? Same thing, the median price for SFR went up to $2 million, and days on the market dropped 3 days to only 17 days. We also had more closed sales, while the price has stayed up. This is showing how much demand we have right now. As for condos, the median price also went up to $957,000 with 22 days on the market, which is 8 days fewer than last month. We had 151 closed sales, increased by 16% from last month.

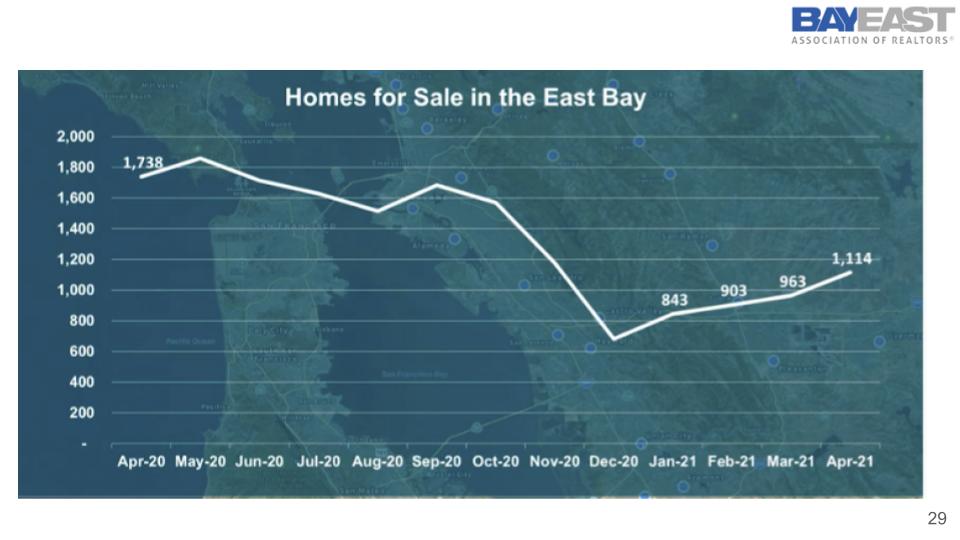

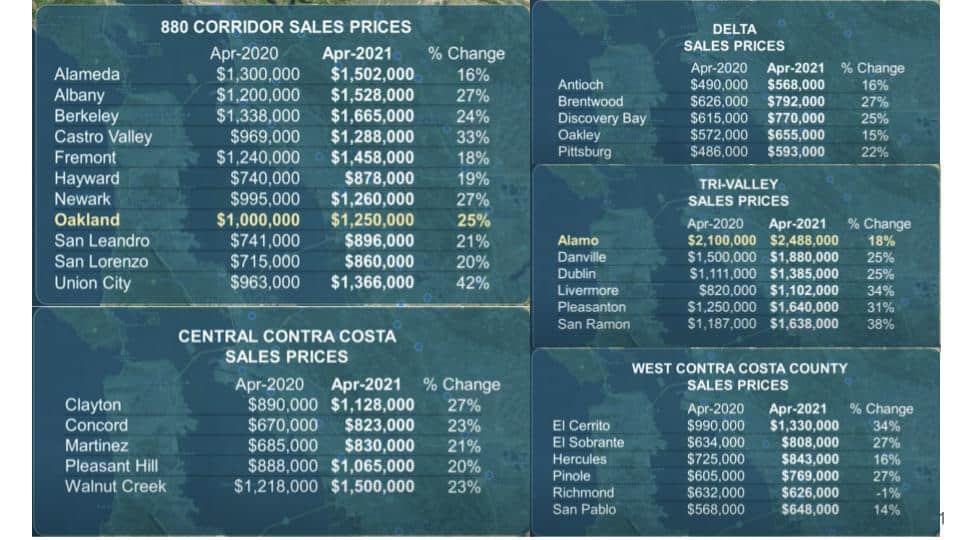

The East Bay is still going up. There are also more sales, but it doesn’t mean the price has come down.

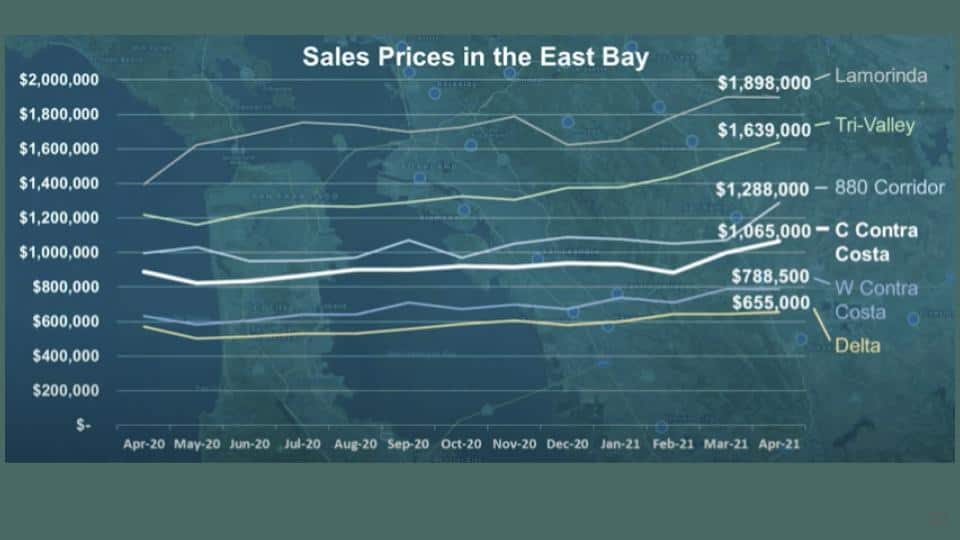

The prices in almost all East Bay areas have gone up quite tremendously.

Just by looking at this chart, we see double-digit increases throughout the whole East Bay.

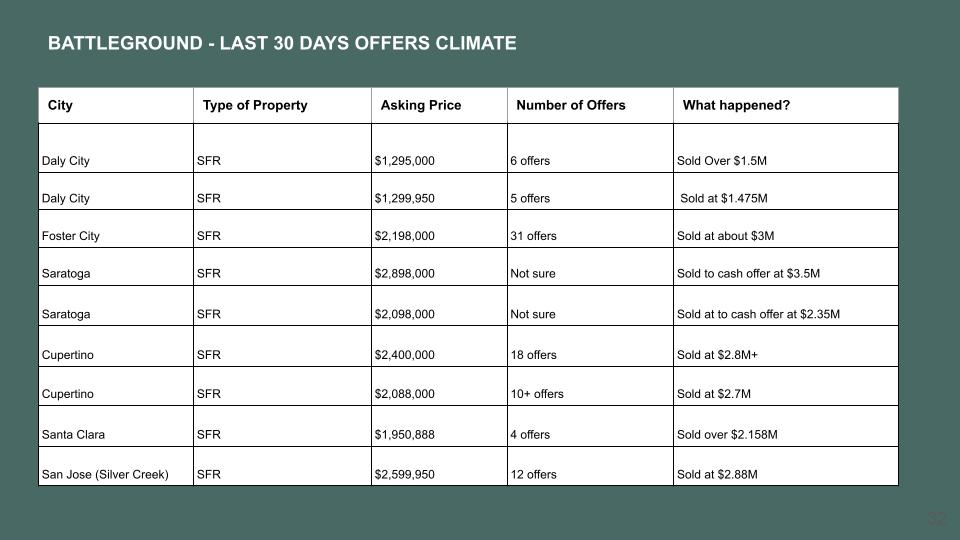

These are, again, some of the offers that we have made or we know of. You can see that pretty much all of them had multiple offers. No matter where it is, from Daly City to Foster City. Look at this – asking right under $2.2 million, they got 31 offers, and it went over $3 million. As an appraiser, how are you going to appraise this? As a realtor, how are you going to advise your clients? As a buyer, how are you going to decide what price you should be offering? The same thing in Saratoga, in these higher-price areas, we still see cases such as this one asking $2.9 million, and sold to cash offer over $3.5 million – that’s $600,000 over. Cupertino, Santa Clara, and San Jose are all areas that have sold price gone way above and beyond asking price.

That’s why we have invited Karen Mann to this episode of the Bay Area Housing Market Townhall. As a certified general appraiser with 41 years of experience, she will share with us her insights on Appraisal Challenges During this Rapidly Rising Market. Watch the full recording here! Finally, if you have any questions or comments, please don’t hesitate to get in touch with us.

Stay up to date on the latest real estate trends.

And what to check before upgrading your internet plan

HAYLEN, an Asian-owned, people-first real estate firm, selected to steward real estate process for J-Sei Home’s next chapter

You’ve got questions and we can’t wait to answer them.