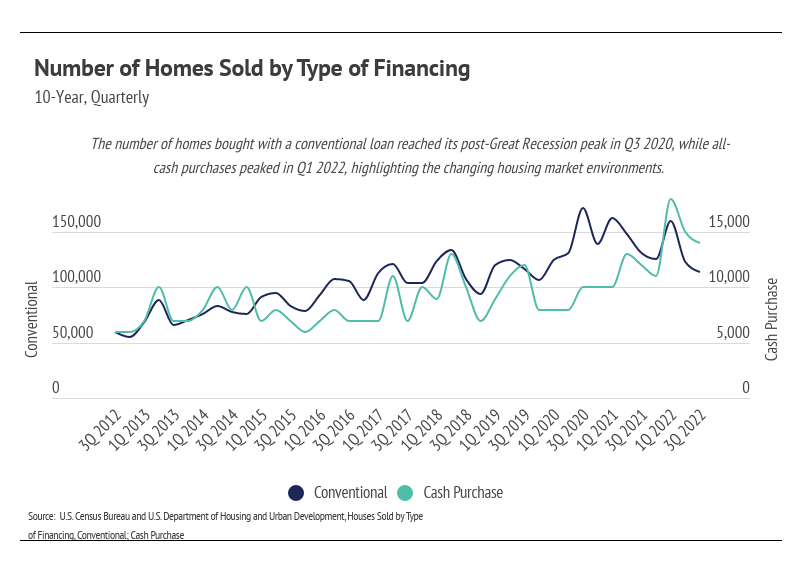

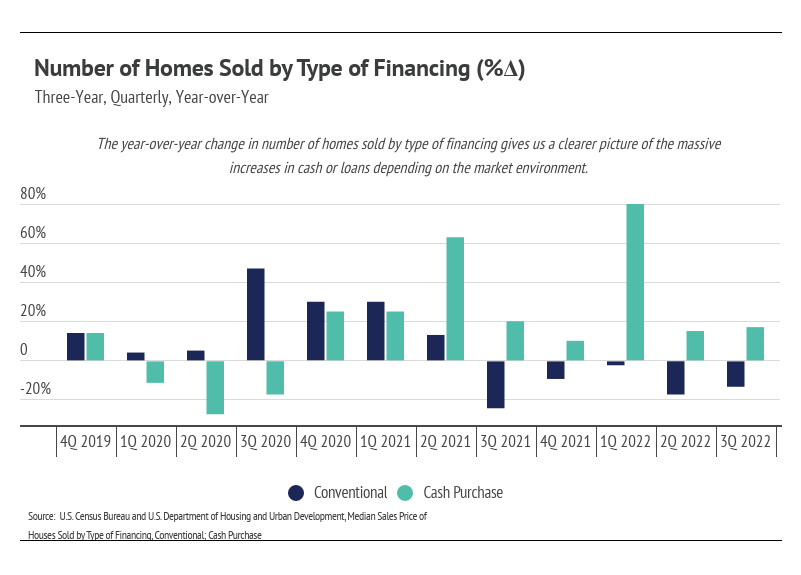

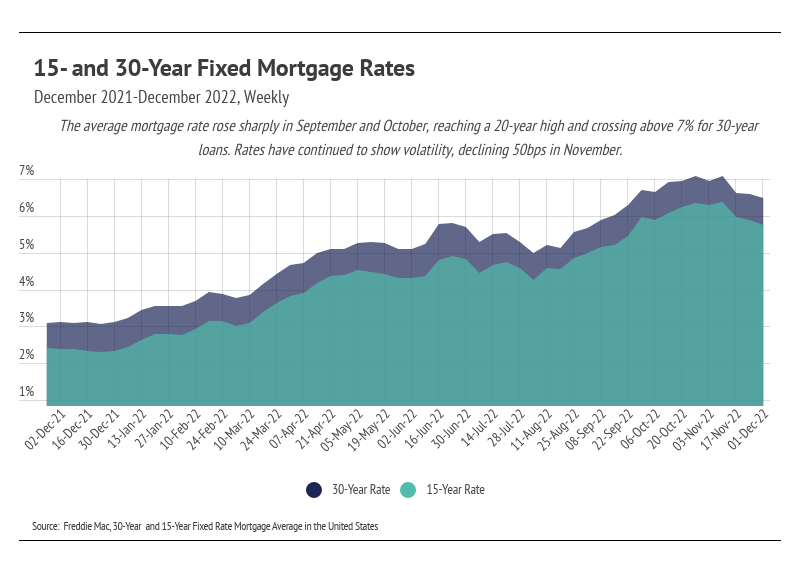

Buyers acted in their financial interest remarkably well between 2020 and 2022, evidenced by the type of financing buyers used to purchase homes during that period. The average 30-year mortgage rate reached record lows in the third quarter of 2020, dipping below 3% for the first time ever. The super-low cost to borrow priced more potential buyers into the market because of the massive increase in affordability. For example, if you can afford the monthly payments on a $500,000 loan at 6% (~$3,000/month), then you can afford a $700,000 loan at 3% (~$3,000/month). Homebuyers, in a sense, could afford more home, so conventional loans rose to the highest level since 2006, and prices rose at the fastest rate in history. Importantly, prices rose quickly, but buyers weren’t getting priced out of the market because of the outsized effect interest rates have on affordability. Financing through conventional loans remained elevated through Q1 2022, which marked a sharp increase in mortgage rates and inflation.

The changing economic environment in Q1 2022 wasn’t lost on cash buyers, either. Inflation was moving higher and depreciating the value of a dollar, which caused all-cash home purchases to jump to the second-highest level on record (just below the all-time high reached in 1988). Buyers’ money was worth more, so spending in the near term had more value. We recognize that cash purchases are far less common, but those who could pay cash chose wisely. We expect all-cash purchases to stay elevated, as mortgage rates will likely remain in the 5-8% range for the foreseeable future. It should come as no surprise that cash purchasers typically have an edge, and that remains true now. However, the typical buyer who finances part of the cost of the home has more opportunity than expected this year.

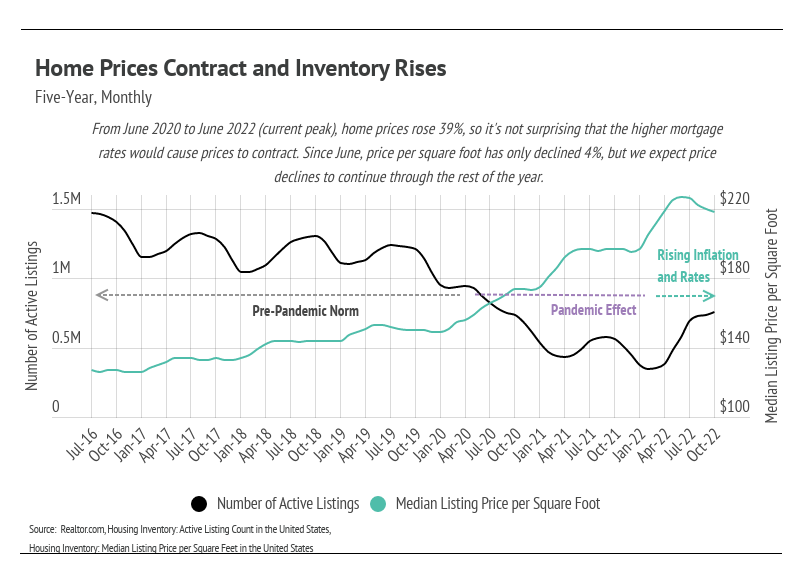

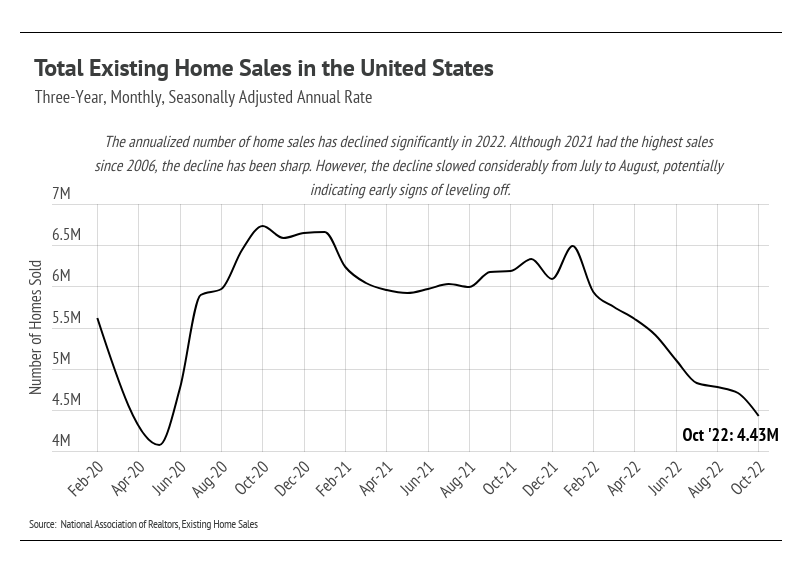

Competition for homes typically softens during the winter months because people focus on the holidays and tend to be less active because of the colder weather and shorter daylight hours. Add in 15- to 20-year-high mortgage rates, prices still near record highs, high inflation, and worries over a recession, and let’s say the competition over homes tends to decline further. This year, sales have dropped every month since January according to the National Association of Realtors, a 32% drop overall. If this trend continues through the rest of the year (current data ends October 2022), which it almost certainly will, 2022 will have about a million fewer sales than 2021. Of course, 2021 had the largest number of sales since 2006, with nearly a million homes sold above the long-term average. With that in mind, it stands to reason that about a million fewer homebuyers than average would be in the market in 2022, especially when considering that financial incentives to buy ended abruptly at the start of this year. We were still surprised to see inventory rise in October after inventory appeared to peak in September.

The housing market has seasonal trends during which home prices and inventory generally rise in the first half of the year and fall in the second half. We will likely have more homes on the market than expected this winter, in a less competitive market, giving buyers a greater chance of finding the right home. Sellers are often buying in conjunction with selling their homes, so more inventory also benefits them.

The U.S. housing market has certainly shifted throughout the year, and we must recognize the current conditions homebuyers and sellers face. Of course, different regions vary from the broad national trends. Take a look below at the Local Lowdown for in-depth coverage of your area. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

Our team is committed to continuing to serve all your real estate needs while incorporating safety protocol to protect all of our loved ones.

In addition, as your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we put together this monthly analysis breaking down specifics about the market.

As we all navigate this together, please don’t hesitate to

reach out to us with any questions or concerns. We’re here to support you.