February 2022 Newsletter – Silicon Valley Local Lowdown

Quick Take:

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

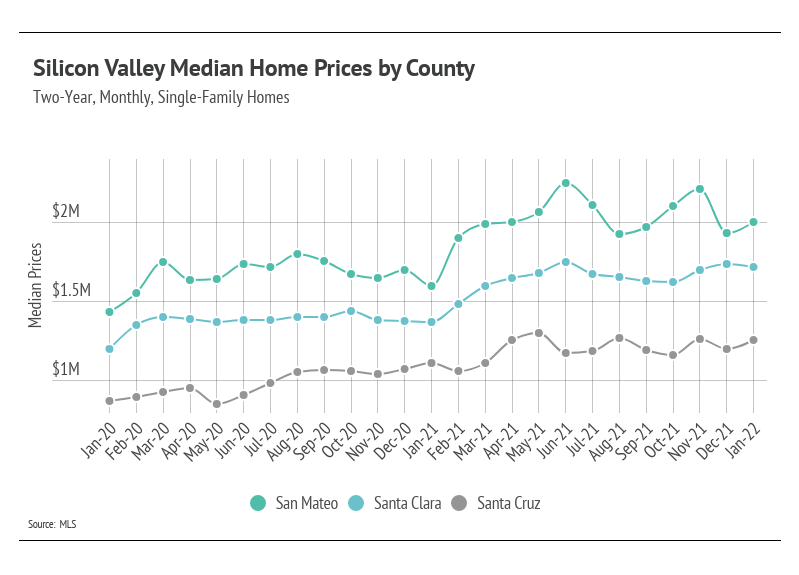

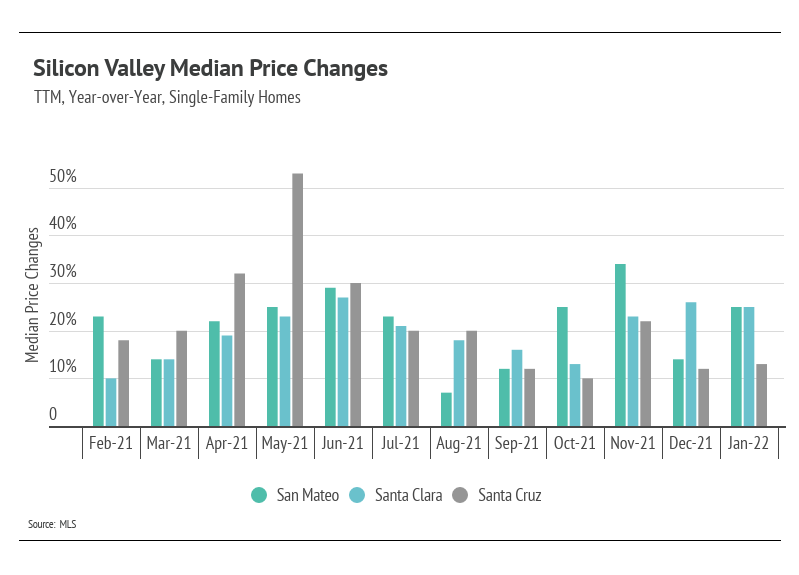

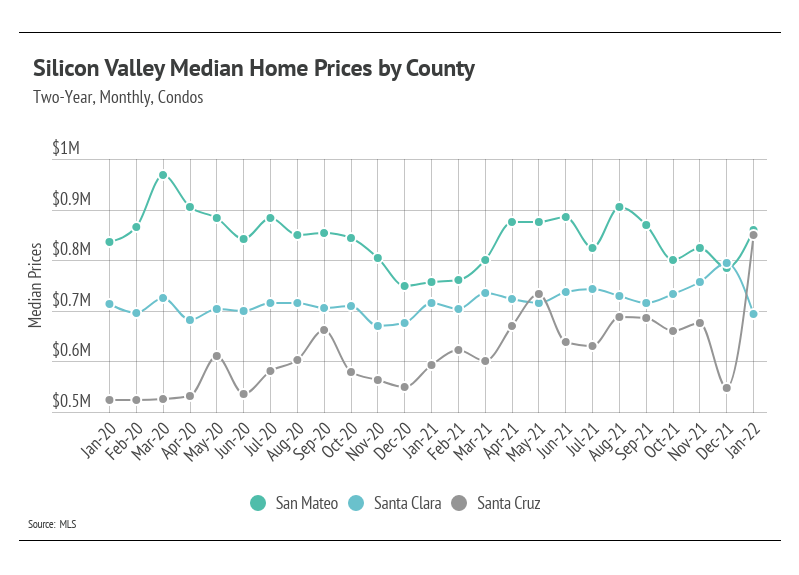

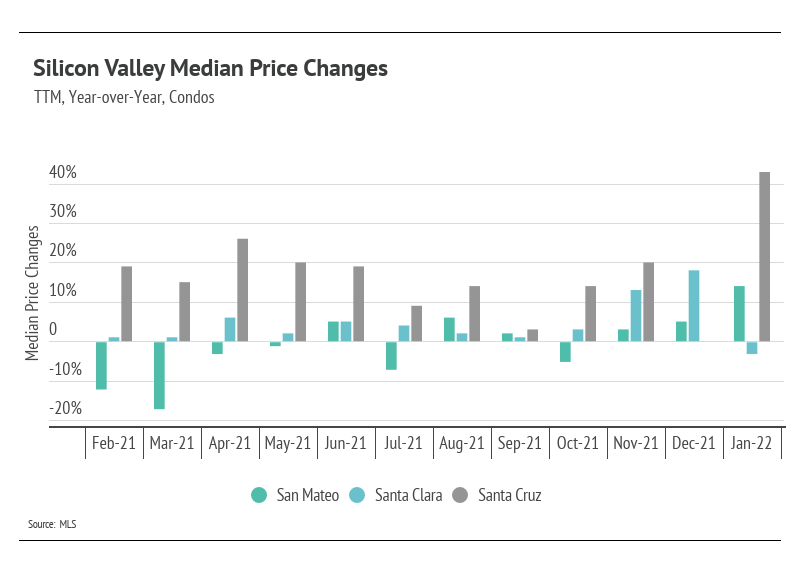

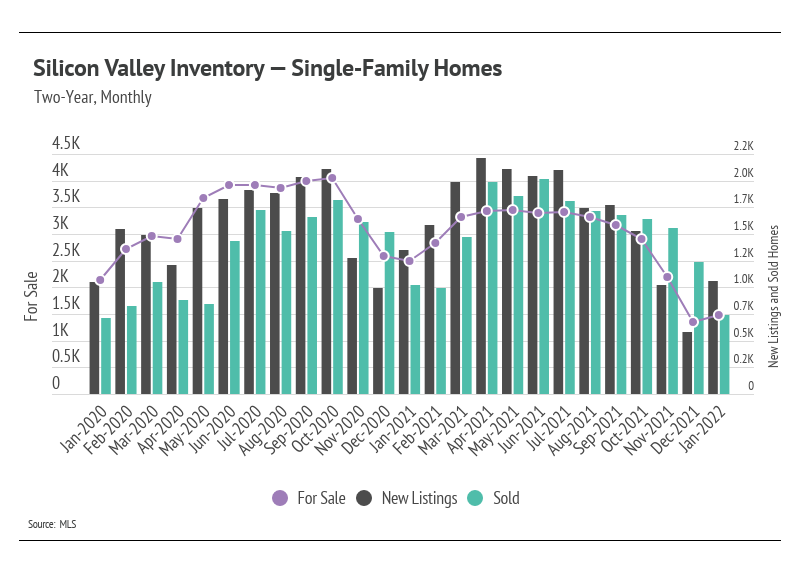

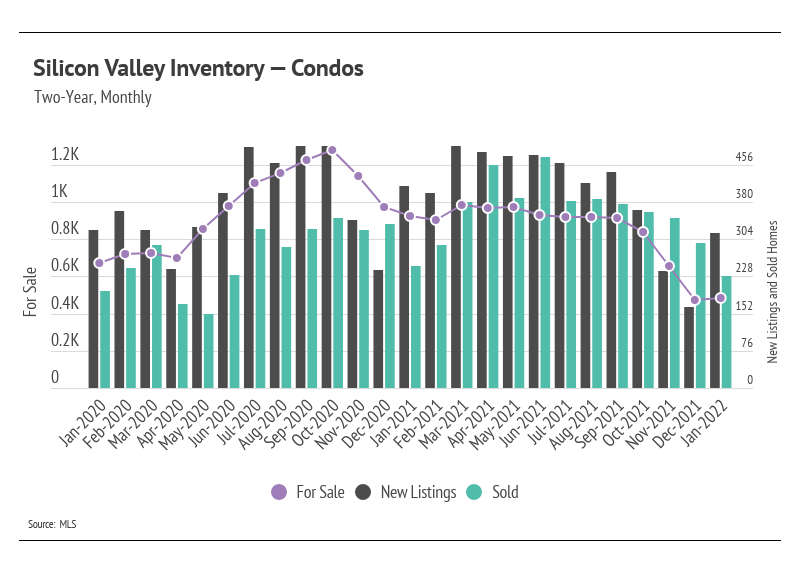

Single-family home and condo prices in Silicon Valley began the year slightly below all-time highs with the exception of the Santa Cruz County condo market, which reached an all-time high in January. After prices appreciated significantly in the first half of 2021, it made sense that price appreciation slowed in the second half of the year, a trend that has continued into 2022. The housing market in Silicon Valley, however, has a major advantage in that a large number of affluent people simply want to live there, which has reduced inventory to record lows.

Mortgage rate hikes really only move demand in one direction: lower. We are now entering a period during which factors that affect prices are more mixed, unlike the past two years when all the factors caused prices to increase. Rising interest rates, which will hopefully curb the still-rising inflation, will make homes less affordable and dampen demand. But inventory is so low that even with less demand, the market will likely be undersupplied. It might seem counterintuitive that home prices can still appreciate after increasing so much over the past two years, but with inventory at record lows, home prices in 2022 will still increase — though at a slower rate than in 2021.

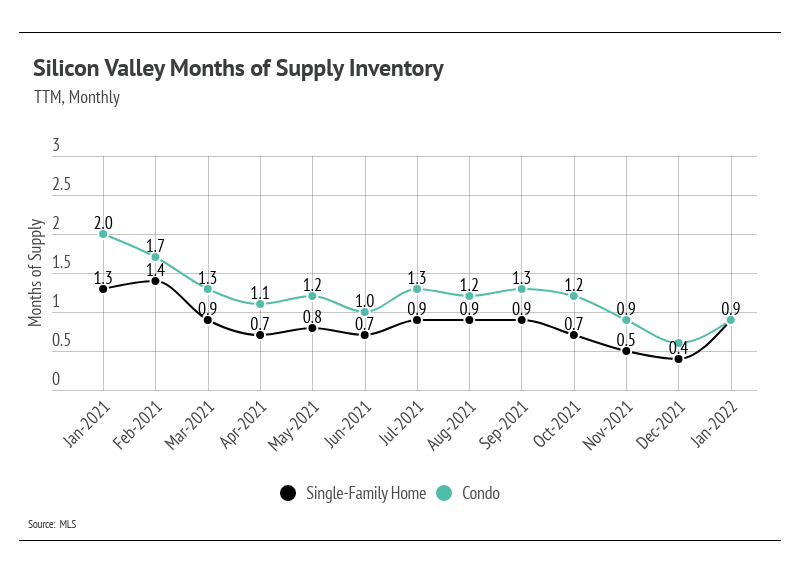

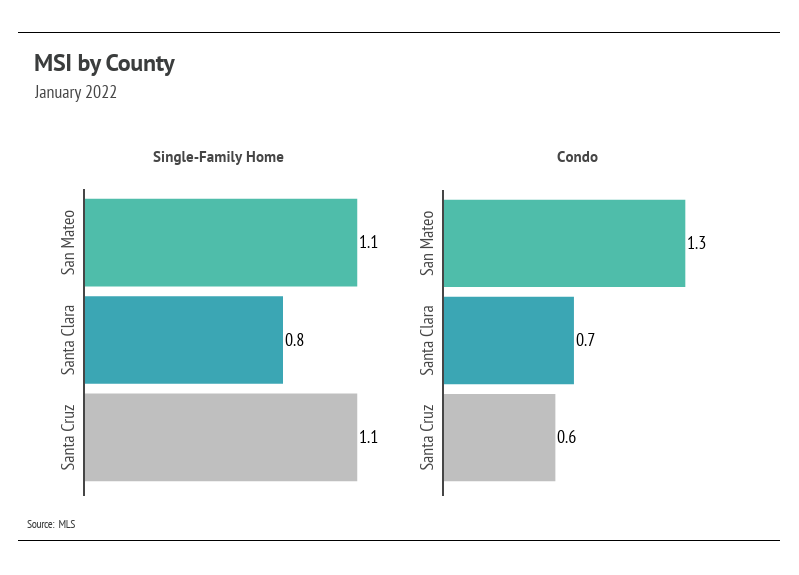

We entered 2022 with historically low inventory. The sustained high demand and lack of new listings over the past year brought supply to record lows across markets. We are seeing that far more people want to live in Silicon Valley than want to leave. Sales have been incredibly high, especially when accounting for available supply, again highlighting demand in the area. Sellers can expect multiple offers, and buyers should come with competitive offers. The high demand we’ve seen over the past year might wane as interest rates increase; however, the supply is so low that the market can handle a drop in demand without negatively affecting prices.

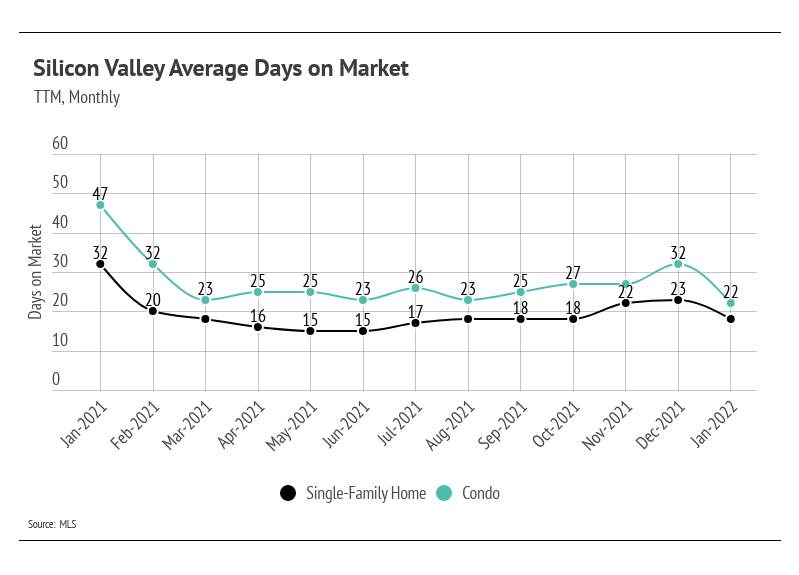

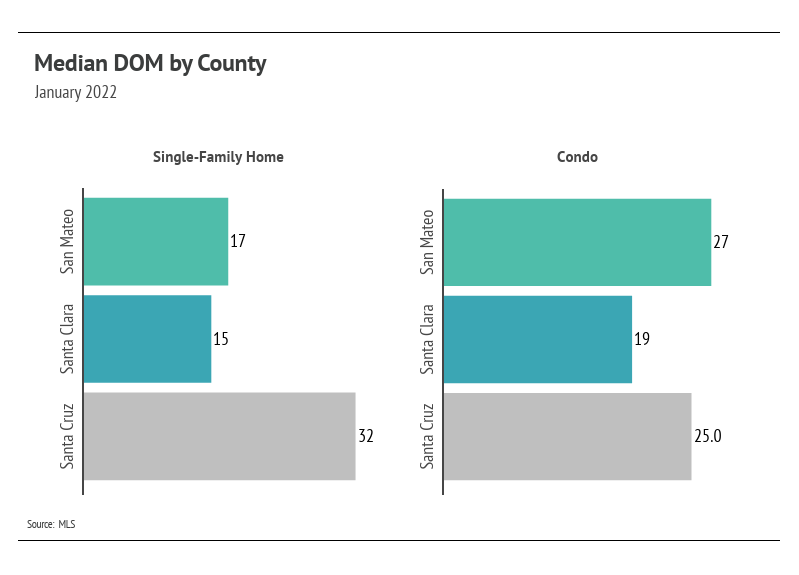

Homes are still selling extremely quickly, indicating the high demand in Silicon Valley. Buyers must put in competitive offers, which, on average, are 3–8% above list price.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). In January, MSI remained exceptionally low in Silicon Valley, indicating a strong sellers’ market. Notably, the January increase in MSI is less instructive than usual — sales slowed because inventory is so low, not because of lack of demand.

Our team is committed to continuing to serve all your real estate needs while incorporating safety protocol to protect all of our loved ones.

In addition, as your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we put together this monthly analysis breaking down specifics about the market.

As we all navigate this together, please don’t hesitate to reach out to us with any questions or concerns. We’re here to support you.

Stay up to date on the latest real estate trends.

HAYLEN was selected for its culturally aligned, people-first advisory approach, supporting the Nikkei-rooted organization through a values-driven real estate transition

You’ve got questions and we can’t wait to answer them.