November Newsletter – Key Topics and Trends in November

In this issue, we dive into some key economic indicators that tend to affect long-term home prices. GDP and employment together explain much of the economic climate and typically trend with housing prices, but they do not explain the current rise in home prices. We will still go over the ins and outs of these indicators, however, because they have received so much press and may affect home prices in the future.

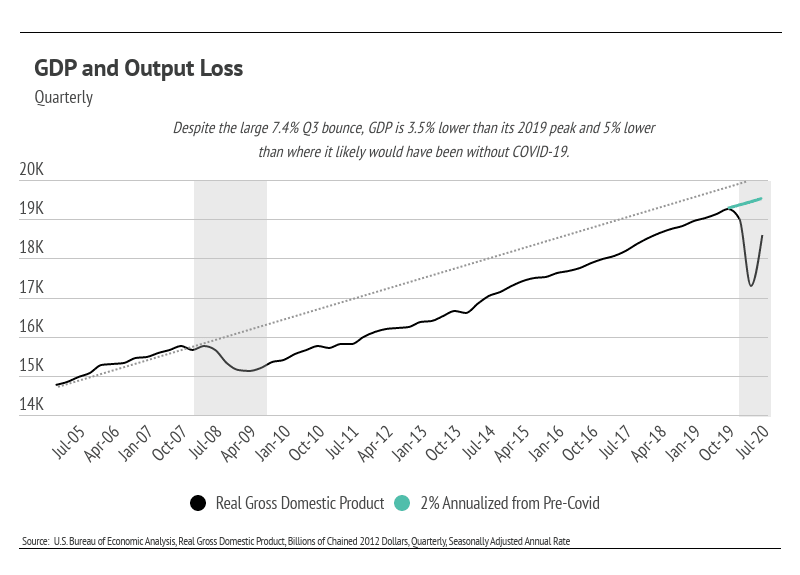

The U.S. Bureau of Economic Analysis reported a 7.4% third-quarter gain to GDP, which is the broadest measure of goods and services produced. During the second quarter of 2020, GDP dropped 9.5% quarter-over-quarter. The second-quarter drop was so sharp that the third-quarter bounce was expected. The long-term effects of the initial drop, however, have yet to be seen. Economists expect lower fourth-quarter GDP growth, which will not make up all the ground lost in the second quarter. Ultimately, the loss in GDP will likely be permanent.

The chart below illustrates the cost of a recession. While it depicts U.S. GDP from 2005 to present, it illustrates economic patterns that occur in all recessions. GDP tends to grow at a fairly consistent rate during economic expansions. The dotted line in the chart represents the predicted GDP had the 2008 financial crisis never happened, and the green line illustrates the expected third-quarter 2020 GDP had the pandemic never happened. As that green line shows, we are 40% below where GDP was expected to be this fourth quarter. In other words, we are still underwater despite the impressive third-quarter 2020 increase in GDP.

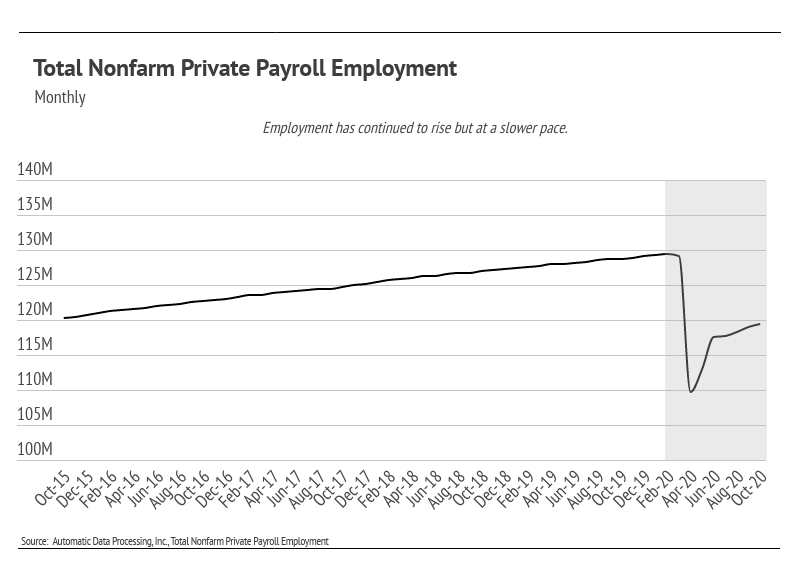

As of October, the Bureau of Labor Statistics reported that 11.1 million workers remained unemployed, which is an unemployment rate of 6.9%. However, the number of out-of-work individuals collecting unemployment insurance has dropped to 7.3 million. In September, the number of unemployed workers and the number of those collecting unemployment insurance were roughly the same. The large number of unemployed workers without government assistance will affect the rental market first, because those working in the hospitality and leisure industries have been most affected by unemployment, and those individuals tend to be renters rather than homeowners.

The employment level does matter in the long term, particularly for the housing market. Disposable personal income and savings, which both dropped in the third quarter, are two of the most important factors when considering whether or not to buy a home. As a result, we will continue to monitor these numbers.

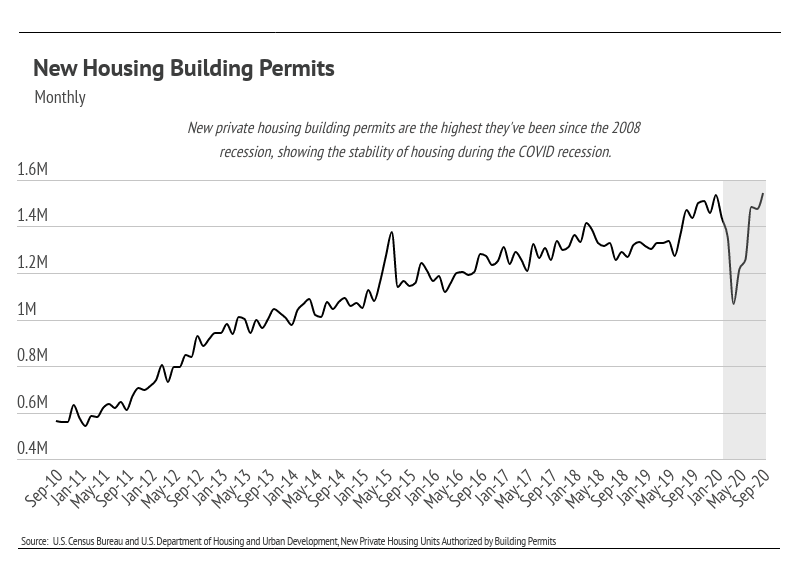

Despite suboptimal major indicators, housing prices have risen considerably. Nationally, home prices have never been higher, and the high demand for single-family homes has dropped the Months of Supply Inventory to the lowest level ever, according to the National Association of Realtors. Months of Supply Inventory is an important marker of real estate market health because it measures how many months it would take for all current homes for sale on the market to sell at the current rate of sales. Low Months of Supply Inventory means that there is a high demand for homes that will push prices higher more rapidly.

Not only are sales of existing homes up, but so are home building permits. The number of home building permits is the highest it’s been since the housing bubble burst in 2006.

The rise in housing demand and price under the current economic scenario speaks to three factors: (1) the asymmetric effect of the pandemic on personal income; (2) monetary policy (low interest rates); and (3) buyer preference. Many people have not experienced negative financial effects from the pandemic. An average person who did not lose their job may have even gained financially through a decrease in expenses. Less opportunity for travel, entertainment, and leisure activities could result in an increase in savings. At the same time, mortgage rates are historically low (2.78% as of November 5, 2020) and will remain low for the foreseeable future, making financing higher-priced homes more affordable. And finally, because so much time is currently being spent at home, buyers are willing to use more of their income to create nicer living spaces, buying larger homes, luxury furniture, and new appliances.

In both the short and long terms, housing is one of the best investments one can make.

Stay up to date on the latest real estate trends.

You’ve got questions and we can’t wait to answer them.